Speaking Engagements UPCOMING

Predict and Prepare sponsored by Workday 12/16

PAST BUT AVAILABLE FOR REPLAY

The Bill Kutik Radio Show® #171, 2/15

The Bill Kutik Radio Show® #160, 8/14

The Bill Kutik Radio Show® #145, 1/14

Workday Predict and Prepare Webinar, 12/10/2013

The Bill Kutik Radio Show® #134, 8/13

CXOTalk: Naomi Bloom, Nenshad Bardoliwalla, and Michael Krigsman, 3/15/2013

Drive Thru HR, 12/17/12

The Bill Kutik Radio Show® #110, 8/12

Webinar Sponsored by Workday: "Follow the Yellow Brick Road to Business Value," 5/3/12 Audio/Whitepaper

Webinar Sponsored by Workday: "Predict and Prepare," 12/7/11

HR Happy Hour - Episode 118 - 'Work and the Future of Work', 9/23/11

The Bill Kutik Radio Show® #87, 9/11

Keynote, Connections Ultimate Partner Forum, 3/9-12/11

"Convergence in Bloom" Webcast and accompanying white paper, sponsored by ADP, 9/21/10

The Bill Kutik Radio Show® #63, 9/10

Keynote for Workforce Management's first ever virtual HR technology conference, 6/8/10

Knowledge Infusion Webinar, 6/3/10

Webinar Sponsored by Workday: "Predict and Prepare," 12/8/09

Webinar Sponsored by Workday: "Preparing to Lead the Recovery," 11/19/09 Audio/Powerpoint

"Enterprise unplugged: Riffing on failure and performance," a Michael Krigsman podcast 11/9/09

The Bill Kutik Radio Show® #39, 10/09

Workday SOR Webinar, 8/25/09

The Bill Kutik Radio Show® #15, 10/08

PAST BUT NO REPLAY AVAILABLE

Keynote, HR Tech Europe, Amsterdam, 10/25-26/12

Master Panel, HR Technology, Chicago, 10/9/012

Keynote, Workforce Magazine HR Tech Week, 6/6/12

Webcast Sponsored by Workday: "Building a Solid Business Case for HR Technology Change," 5/31/12

Keynote, Saba Global Summit, Miami, 3/19-22/12

Workday Rising, Las Vegas, 10/24-27/11

HR Technology, Las Vegas 10/3-5/11

HR Florida, Orlando 8/29-31/11

Boussias Communications HR Effectiveness Forum, Athens, Greece 6/16-17/11

HR Demo Show, Las Vegas 5/24-26/11

Workday Rising, 10/11/10

HRO Summit, 10/22/09

HR Technology, Keynote and Panel, 10/2/09

Adventures of Bloom & Wallace

|

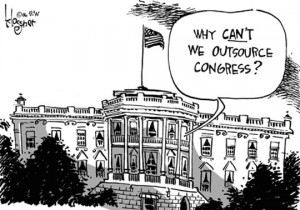

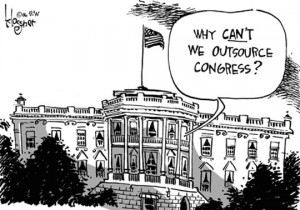

If Only We Could, Tea Party First! Before Bill Kutik has a chance to tease me about the intensity (aka length and depth) of this post, be forewarned that there is serious “how to” material below.

Every organization outsources parts of HRM, almost no matter how your define outsourcing. From using 3rd parties to do background checking or COBRA administration (both of which are always done with some flavor of BPO, with the provider supplying the people, process and technology) to using 3rd party assessments and drug testing services to every flavor of 3rd party payroll services, outsourcing is central to the HRM delivery system — and it has been for as long as I’ve been working. So the question isn’t should we or shouldn’t we outsource but rather what, when, how, to whom, at what cost, with what governance, etc.

The right way to approach HRM outsourcing is to consider this option for various HRM processes in the context of developing an overall strategic HRM and HRMDS plan. Just “Follow The Yellow Brick Road” (https://infullbloom.us/?p=823 https://infullbloom.us/?p=848 https://infullbloom.us/?p=865 and https://infullbloom.us/?p=885) to develop your plans if you don’t already have them.

But with or without having developed such a strategic HRM and HRMDS plan, because of the prevalence of outsourcing in HRM, we’re always getting hit with the “Why don’t we outsource X?” questions. The purpose of this post is to equip you to get in front of those expressions of outsourcing interest or opportunities for further outsourcing so that you’re not blindsided and immediately on the defensive. Using these questions may buy you enough time to do a proper strategic HRM and HRMDS plan so that you’re not caught off balance by the next outsourcing suggestion/proposal.

When you’re faced with the “Why don’t we outsource X?” question, or preferably before you get that question, you should always ask (and be prepared to answer) the following:

- Is this outsourcing proposal compatible with our strategic business and HRM plans (e.g. to improve our competencies in our strategic HRM processes), or is it intended to address temporary tactical problems (such as a reluctance to invest in the next HRMS upgrade)?

- Are the outsourcer’s employees going to give us better service than our own workforce? Why? How? In the face of tight deadlines and downward pricing pressures?

- What will we do with any displaced staff? Are we prepared to let them go or do we really have better, more important, more profitable uses for their KSAOCs?

- How will we continue to develop excellent HRM and HRMDS strategists, HR generalists and specialists, and HRM software vendor and outsourcing provider managers if we accept this outsourcing proposal? With this part of HRM done by a 3rd party, what will we give up in developmental opportunities? Does it matter?

- How will we control costs with sufficient granularity if the provider bundles everything into one fee? What pricing structure(s) would work best for us? Is that what is proposed?

- What are the implications of this outsourcing proposal if we merge with another organization of our size? What if we divest a major part of our organization?

- What are the implications of this outsourcing proposal if another organization wants to buy us? Are there any unattractive contract buyout provisions? Any unattractive migration considerations if we were to move to the acquirer’s capabilities?

- What are the implications of this outsourcing proposal if we sell off peripheral businesses and focus on our core business(es)?

- How are contract fees adjusted when business activity slows and/or we downsize? What about when we grow and/or business activity quickens?

- How do we know that these financial projections are accurate? What assumptions (simplifying, optimistic, or plain misleading) have been used to prepare these numbers?

- Since change is a sure thing, how can we be sure that the proposed outsourcing contract will protect us as much as it protects the outsourcing provider when change happens?

- Against what change scenarios should we test this proposal?

- What changes will our employees/managers notice? Will these changes be received as positive? What’s the upside and downside on their reactions on their productivity and on organizational outcomes?

- Will our best HR and HRMDS staff resign the minute they sense the intent of this outsourcing proposal? What’s the upside and downside if they do?

- Why is this being discussed/proposed now? What’s the impetus for this outsourcing proposal?

- Is the timing of this suggestion/proposal convenient with respect to our HRMDS planning cycle, budget cycle, organizational change cycle, etc.?

- What is the fit between what’s being proposed in terms of process design, data structures, business rules, etc., and what we do today or wish to do? What scenarios should we use to test all the important topics?

- Is the impetus for this outsourcing proposal contained in an investment plan to bring our current HRMDS to meet the standard needed to sustain our business?

- If we took a careful look at what our HRMDS needs to support our business outcomes, would we be shocked by the level of investment?

- Are there any unspoken motivations behind this outsourcing proposal, e.g., is it a substitute for examining what may have been poor decisions already made in our choice of ERP vendors, systems integrators, benefits consultants, etc.?

- Are there internal politics at work? Is it possible that the proposer is hoping to deflect attention from their own part of the organization by stirring up some dust in HR?

- Is it possible that the outsourcing provider putting forth this proposal has something other than our business needs and best outcomes in mind?

If you think these are tough questions, the best are yet to come! Here are more zingers for evaluating any unsolicited outsourcing suggestions/proposals that come at you, not as an intended and very sensible byproduct of strategic HRM and HRMDS (human resources management delivery systems) planning—although they’re useful in that context as well—but as a response to the “Why aren’t we moving more aggressively to HRM BPO?” question often asked by a returnee from the latest provider briefing or sales event cloaked in thought leadership. Here we go:

- Who’s going to manage the financial aspects of this outsourcing proposal to ensure that we achieve the intended results? How? Do we have the people, processes, and technology to do this effectively? What would it take to put them in place? Has this been factored into the outsourcing idea or proposal?

- Who’s going to manage the implementation, including systems integration, aspects of this outsourcing proposal to ensure that we achieve the intended results? How? Do we have the people, processes, and technology to do this effectively? What would it take to put those people, processes, and technology in place? Has this been considered in the outsourcing proposal?

- Who’s going to manage the performance aspects of this outsourcing proposal to ensure that we achieve the intended results? How? Do we have the people, processes, and technology to do this effectively? What would it take to put those in place? Is this part of the business case for the outsourcing proposal?

- Has our lawyer negotiated at least as many HRM outsourcing contracts as the outsourcing provider’s lawyer?

- Do we have the legal and vendor management horsepower needed to make this work for our organization? What is that aspect of the arrangement going to cost?

- Where will our HR executive, CFO, CIO, or other executives be two years from now? Will they be as enthusiastic (or as unenthusiastic) about this proposal if they are going to be judged long-term on how well this strategy works for our organization?

- Where will our outsourcing provider’s account executive, operations executive, or other executives be two years from now? Do they have as much at stake as we do professionally? What’s their track record for delivery? What’s their record for staying in place long enough to experience the reality of meeting their commitments?

- What if the outsourcing provider our organization likes and selects is then acquired by an outsourcing provider our organization rejected because of their management style, ethics, customer service track record, technology, geographic coverage, etc.?

- How easily can our company get out of the outsourcing contract? What if the outsourcing provider we like and selected decides to exit the business (for whatever reasons)? How easily can our organization find another provider, migrate to that provider, and absorb the costs and disruption of such a change?

- Frankly, how can our organization escape from any comprehensive HRM BPO provider, among many other considerations, when a full self-service rollout is part of the proposal and any change in that rollout, e.g. to another provider’s self-service software, would be visible and disruptive to our entire workforce?

- If we accept this outsourcing suggestion/proposal, is there any going back once it’s implemented? If our company changes its mind in two or three years, what’s involved in bringing this activity, function, process, or integrated processes, along with the relevant HRMDS components, back in-house?

- What would it take to move to another provider once we have implemented with the first one?

- Is our company going down an irreversible path? Do we care?

As strongly as I support the use of HRM outsourcing — from gaining access to expertise via the use of expert resources to using business applications packages rather than “rolling our own” to every flavor of HRM and IT process outsourcing — there really are some outsourcing proposals that should be drowned at birth. Hopefully, some of the above questions can be used, judiciously, as the cement shoes for that purpose. But even when the outsourcing suggestion/proposal is otherwise reasonable, when it has emerged during a well-run strategic HRM and HRMDS planning project, there are still many questions you need to ask to address the fit between the outsourcing suggestion/proposal and your way business needs and way of doing business. There are also important questions about what potential providers can offer, and why you would consider a specific approach and provider. Sounds like we’ll need some more intense posts before we leave this topic.

- Sunset Over Lake Devonwood

Some time back I wrote about the cattle, gators and eagles at B&W headquarters. Our home and my working office are on Lake Devonwood, which began its life as a quarry when they were building the Tamiami Trail back in the 20’s, and now it’s become so naturalized that the only way to realize its origins is to see this area from the air. And that’s something my neighbor does routinely as he takes off and lands his helicopter from one of the pastures at the end of the lake.

For me, the best part of living here is that nature has claimed Lake Devonwood as her own, with river otters, all manner of water birds, the visiting alligators, tons of fish, and many small mammals, from rabbits to raccoons, presided over by the ever watchful eagle family.

Taking a break from the heads down work of updating my magnum opus (all 3,000 pages or so of object model/architectural “starter kits”), I spent a few hours yesterday and again this afternoon doing what I do best — reading classic British mysteries, swimming laps (I work out all my presentations in my head as well as planning travel dreams in this otherwise most boring of activities), and watching life go by. And life today included the parent eagles patiently teaching their very large offspring how to bring home the dead fish.

You’ve never heard anything so absurd as the sound of an eagle fledgling whining because he just can’t get that damn fish or the equally absurd but higher and louder squeals of parent eagles encouraging baby. G-d must have a sense a humor or these majestic birds wouldn’t sound like squeaky toys — but they do. So, for two calming, restful hours, to the continuous squeaking of parents and child, I read and swam and picked up a little color. I also worked through a number of client issues and upcoming presentations in my head and thought about going up the Amazon in 2012.

Now it’s sunset over Lake Devonwood, and I’ve been back to the “starter kits” for the last few hours. But my weekend has been wonderful. Hope yours was too. In a world filled with so much truly awful news, I am very grateful to have had another healthy day by the shores of Lake Devonwood.

- Lars Lawson — The Symbol Of All Things Lawson

I first wrote about the HRM enterprise software “Snowdons of Yesteryear” (with apologies to Joseph Heller for this misuse of his famous phrase, “where are the Snowdons of yesteryear” in Catch-22) in the earliest days of this blog (so 11/2009). In that original post, I reflected on the last great generation of HRM enterprise software, a mainframe generation that peaked in the mid-1980’s. It’s a generation of market leaders that most of my younger colleagues (and that now includes almost all of my colleagues) have never encountered because they were wiped off the charts by SAP R/3, Oracle EBS, PeopleSoft, Lawson, Ultimate, and a huge burst of various niche HRM applications when the industry shifted from mainframe to client server in the late 80’s/early to mid-90’s. But it’s worth noting that many companies are still running on these 1st generation HRM packages and are being supported by their 3rd, 4th, 5th or later owners, collecting those maintenance fees and trying (in some cases succeeding) to provide some level of functional and technical enhancements — until they turn out the lights!

Then, late last year (12/2010), I wrote again on this subject, but this time I was describing how much of today’s most widely implemented, client server converted (not re-imagined and rebuilt) to Web-based, HRM enterprise software was itself about to become yesterday’s news. This post is worth a re-read, not only because it’s a pretty good short history of HR technology but also because it makes a number of observations about what’s to come and names names. One company mentioned in that post, Spectrum, has already disappeared into Epicor, which has plans to bring Spectrum up to the standard of Epicor’s own technology. This is a far cry from SaaS InFullBloom, but it could give Spectrum customers a path forward. Or at least it could have done until it was announced that Apax Partners, a private equity firm, is buying Epicor, folding it into something else, and doing who knows what with any investment plans for Spectrum.

But most important for this current post is that I wrote in the earlier one, although I had already tweeted this point a few times, that I believed strongly that Mr. Debes’ (Lawson’s CEO) wrong-headed stand against true SaaS was a major detriment to his firm’s having an independent future. And now it’s all coming home to roost. Lawson will likely be acquired by the only offerer-to-date, Infor, known in many circles as a (but by no means the only) ERP graveyard. This is where old software goes to die, to be milked for its installed base’s maintenance revenues with only modest, ongoing upgrades, doing just enough to retain that installed base. I could be very wrong, and I surely hope I am. Perhaps Infor is cooking up the next generation of ERP in their labs, thus providing Lawson customers with more than just a way forward. But thus far I haven’t been able to find any concrete evidence of this or even any such speculation. There’s been a ton of commentary on Infor’s offer (see below for a list of some relevant items), but my own take is that this is a done deal. There’s always the chance of another offer, and IBM would be an obvious choice if they wanted to be in the ERP business given their long-standing relationship with Lawson. But there just aren’t any signals from IBM that they’re interested in having an ERP on offer, let alone one that’s needs considerable investment.

My heart goes out to the HCM product team at Lawson, to folks who have done a very good job under tough circumstances, folks who could have innovated a lot more aggressively if they hadn’t been up against Mr. Debes’ misunderstanding of the generational shift to true SaaS. Their acquisition of Enwisen was a very smart move, but I have to wonder if Infor will value and be able to retain the subject matter experts who are critical to the maintenance and use of Enwisen’s personalized content. My heart also goes out to Lawson’s customers who, not unlike PeopleSoft’s customers before its acquisition by Oracle in 2005, signed up for the long haul with a known leadership team and then found themselves with new owners whose modus operandi was quite different. Oracle has put out two major releases — 9.0 and 9.1 — for PeopleSoft in the 5-6 years since they acquired that company, and 9.2 is discussed for 2012, but there sure as hell won’t be a 10.x. If Lawson disappears into Infor, I fear that its very competitive (in their target market) HCM products will suffer a fate to that of PeopleSoft, getting periodic functional enhancements (but not at true SaaS speed, which is increasingly important in today’s high speed environment) but not the level of investment that’s needed to innovate architecturally, re-imagine HRM, or to be a leader in some of the newer HR technology capabilities.

There’s an important lesson here, and one that all HR leaders and their organizational peers should heed. If your HRM business applications vendors aren’t pushing themselves and you every day to seize that next generation of technology — to seize SaaS InFullBloom right now — then they may well be destined for tomorrow’s software graveyards. Even if they’re doing a great job of bringing you the functionality you ask for and want today, if your HRM software vendors aren’t operating at true SaaS speed, moving their products quickly to true SaaS(which is table stakes in 2011), they may well lose momentum, and that’s the kiss of death for a publicly traded or investor-financed company in a market that values momentum above most everything else. With the big Mo, they and their customers are at serious risk of becoming the next Lawson. I hate that this proud company, with an important legacy of industry focus, strong HCM products, and management integrity, may well disappear into Infor — a very sad ending indeed.

For more on this story from my twitterstream (and you thought I didn’t archive these for later search/reuse?):

- Will layoffs at Lawson affect HCM products? Your thoughts? 5:31 AM May 19th 2009 — this in response to the announcement that Lawson was doing major layoffs. These did help to reduce their cost structure and improve, in the short term, their financials, but it did nothing to address their primary challenges around innovation.

- RT @dealarchitect Netsuite Cash for Clunkers http://tinyurl.com/l2kl2y Lawson’s bid to keep making clunkers http://tinyurl.com/kvrg6v 6:47 PM Aug 19th 2009 — and please do read Vinnie’s early blog post on Mr. Debes’ (Lawson’s CEO) wrong headedness re: true SaaS.

- Jeff Comport, after many years with Gartner, returns to his roots as SVP Product Mgmt across all products at Lawson. Go Jeff! 4:08 PM Nov 1st 2009 — this when Jeff Comport, whose last software vendor gig was with the first generation of Snowdons, then Integral systems, before doing a very long run at Gartner before getting caught up in Gartner’s layoffs. Frankly, I thought Jeff wouldn’t have taken this position unless he had full authority to re-architect Lawson’s S3 line, but I was sadly mistaken.

- @paulhamerman Any sign that Lawson sees their refusal to entertain true SaaS as a contributing factor? 3:21 PM Jan 25th 2010 — this in response to Lawson’s disappointing financial results.

- Another article on Lawson Amazon cloud: http://www.crn.com/software/224201218 > Is there any BFD here? 5:07 PM Apr 5th 2010 — this in response to Lawson’s “cloud” announcement, which was really about hosting their single tenant existing software on Amazon’s EC2, which Lawson was trying to pass off as their approach to the “cloud,” which Jeff Comport was redefining as really only about virtualization and elasticity.

- @paulhamerman #Lawson quarterly update shows company is reasonably profitable and fiscally sound. Innovation agenda not evident, hope to learn more at CUE 12:55 PM Apr 16th 2010 — this is just one of many public notes about the lack of an innovation agenda at a time when their ERP/HCM competitors were focusing heavily on innovation, to include SAP’s Business ByDesign next generation offering (which is coming into its own in 2011), Oracle’s Fusion Apps (also likely to emerge during 2011, but there’s been little news on this of late), Workday (with its entirely new architecture, very capable leadership team, and agressive build-out), and many of the talent management suite vendors.

- Why hasn’t anyone been talking about Carl Icahn’s taking a major stake in Lawson. This guy doesn’t wait for mgmt to deliver value! 7:31 AM May 26th 2010 — at the very first hint of Carl Icahn’s buying shares in Lawson, the die were cast, at least in my mind. With no true SaaS/next gen strategy, a poorly integrated acquisition with Intentia, shares that simply weren’t getting the kinds of multiples that other HCM vendors, e.g. SuccessFactors and Taleo (we can’t even mention Cornerstone OnDemand at that point in time), and even their flagship and well-respected HCM products not being able to deliver innovation at the needed time-to-market because they lacked a true SaaS offering, I believed that there was no way Carl was going to see the return he expects without selling off Lawson — and said so, as did others.

- Heads up Lawson customers. Icahn buys in. RT @mfauscette Lawson To Cut 150-200 Jobs; Davenport Downgrades http://tinyurl.com/38ybj68 3:25 PM May 28th 2010

- dbmoore #EnSW #Lawson Software To Cut 150-200 Jobs; Davenport Downgrades: Johnstone says the company could fetch $12-$13 a… http://dlvr.it/1Hnx1 10:15 AM May 29th 2010 — another layoff (which isn’t usually a sign of heavy investment in innovation), financial analyst downgrades, and hints of a sale?

For more on this story from others (and please send me your stories if you’d like me to add them here):

In the spirit of full disclosure, much of my work is with software vendors, and I’ve had a hand in many next generation products beginning way back with that first generation of mainframe HRMS’ and continuing up to today’s stealth projects whose results won’t be seen for another year or more. Lawson has not been a client, but I have had a long-standing and valued relationship with their HCM product team.

Ultimate HQ In Weston Florida I rarely attend vendor user conferences unless I’m an invited speaker or otherwise participating at the request of that vendor, so I’m the last person to offer a learned comparison of conference venues, programs, parties, swag, logistics, etc. But one thing I have observed is how much of a vendor’s corporate culture is on display at these conferences along with all the new product announcements, product roadmap revelations, showcasing of partners and customers, networking events, thought leadership sessions and “get down and get dirty” product sessions.

And that’s what struck me about last month’s Ultimate Connections user conference (full disclosure below), their corporate culture. I had the run of the place, went where I wanted to go, talked with customers to my heart’s content with no handlers present, met with some Ultimate folks I didn’t know to include with my analyst hat on (although everyone knows that I’m not a real analyst in the research-producing sense), and was made to feel very welcome — as were all the customers with whom I spoke or on whose conversations I eavesdropped (and I did that a lot). I wish I had had time to write this post a lot sooner, when I was still feeling the glow from all that customer/vendor love, but life just got in the way. For another visitor’s most timely views, here’s a post from Amy Wilson of Constellation Research Group, whose founder/CEO Ray Wang was the other keynoter.

I didn’t attend the opening night festivities so can’t report on that event, but one thing became very clear that next morning. This was by far the largest customer event that Ultimate had ever hosted, and one of the key takeaways from CEO Scott Scherr’s heartfelt welcoming remarks was his huge shout-out to a very young staff member, Ashley Perkins, who had been the point person/major domo for all the conference arrangements. Now everyone looks young to me, but Ashley’s just in her mid-20’s, and she and the others working with her certainly had their hands full with such a large event. But there was their CEO, in his very opening remarks to all the attendees, publicly investing in her — and in his entire team by extension — his confidence and support.

That’s exactly how you get great teams to form in the first place, to stick together in good times and bad, to set high standards and big goals for themselves, and to do more than anyone ever thought they could do. As Scott continued his review of Ultimate’s progress, accomplishments and future plans, that theme ran all through his remarks. Every customer in that room was told that it hadn’t been all rosy in the past (as in we just came through the worst recession in our collective memories), that there would be challenges in the future (competitive, geopolitical and economic), but that the Ultimate team, in which every employee counts, had gotten them this far and would take them a lot farther. NO chest-pounding, arrogant bull-shit from this CEO, just a down to earth presentation of their company’s past accomplishments and intended future along with his clear confidence in the team.

A great message with which to launch their conference at a time of tremendous challenges for every HRM software vendor. If you think it’s been a tough competitive landscape up til now, just imagine how full the vendors’ plates are with global, social, mobile, embedded intelligence, predictive analytics, and the list goes on. Scott was followed by Laura Johnson and Adam Rogers talking about their product roadmap and then my keynote, which hit on all the work ahead of them and their competitors. Big agendas, lots of work and challenges ahead, and only great teams will be left standing. That was the core of Scott’s message, and I agree. Our industry’s consolidation is well underway, and there’s been a lot of churn in leadership roles, but it’s my opinion that great leadership teams, just like great product or development or sports teams, take time to jell and learn to operate at full force.

Another example of Ultimate’s culture was on display at the end of the conference’s first full day. There was a general session Town Hall meeting at which a panel that included each of the execs running key parts of Ultimate’s business took questions from the audience, and some of those questions were zingers. Tough questions, not always tactfully stated, some calling attention to very customer-specific product and service issues were met with candor, often surprising candor, and humility. No Scott or Marc Scherr on the stage, just the key person responsible for these functions. For anything that was under their control and didn’t go perfectly, these Ultimate folks discussed the background of the issue, the corrective steps taken, and their commitment to doing better via specific process, product or other improvements. Sitting in that room, I was struck by the lack of bad vibes, uncomfortable at times but not negative. There were just tough questions and responsive answers. And most to all of the customers present, really most to all of Ultimate’s customers, are running their absolutely mission critical payroll processes on Ultimate. These payroll processes may not be strategic or even very exciting, but when jeopardized, they suck all the air out of anything else that HR, IT and Finance folks may want to do. So Ultimate’s customers know that they are on the firing line every day, and it was clear that Ultimate takes seriously being there with them.

Separate from the display of corporate culture, something else that struck me at Connections was the interest attendees had not only in what’s coming but also in how to make the most effective possible use of what’s already here. Given Ultimate’s long-standing capabilities in core HR recordkeeping, payroll and benefits, it was interesting to speak with customers who have rolled out, or are in the process of doing so, a range of talent management capabilities that are also a part of Ultimate’s product suite. Are these talent management capabilities as sexy or deep and complete as those from the best of the talent management suite vendors? Not on a feature by feature basis, although they have an aggressive roadmap for 2011. But the fact that they are truly integrated across the entire system of record does matter, and the fact that they are truly SaaS (except for a rapidly shrinking set of long-standing on-premise customers) means that new functionality will be coming right along at a pretty fast clip and without the pain and suffering of on-premise upgrades.

We are very fortunate in our industry to have some exceptional corporate cultures and leadership teams, to have long-standing and very passionate groups of leaders who are committed to excellence in human resource management products and services, and Ultimate is by no means the only example of this important aspect of vendor viability. If I were a buyer of these products and services, in addtion to paying close attention to the underlying object models and architectural characteristics of their platforms, something I’ve written about extensively on this blog, I’d also pay close attention to the folks with whom I’ll be doing business. In a self service and SaaSy world, signing up should still be viewed as getting married to your vendor (and to its leadership) because moving from one vendor to another is a MAJOR disruption when you’re talking about an implemented core HRMS or integrated talent management suite. The biggest takeway for me from attending Connections, which really isn’t about Ultimate per se, is that I must add to my thinking about HRM software/services vendor evalution a lot more emphasis on what to look for in the management team. To be continued….

Full disclosure: Ultimate Software is a current client. I was compensated plus having my travel expenses covered for delivering the first day keynote address at Connections 2010 and for doing a Town Hall-style Q&A session at the end of the second day with Jason Averbook, the founder/CEO of Knowledge Infusion, whose company was a Connections exhibitor. I’m also an uncompensated advisory board member at Constellation Research Group. Spending additional time at Connections to meet with Ultimate executives, talk with their customers, attend sessions, etc. was entirely on my own time.

- HRM May Not Need Battlestar Galactica Capabilities

My first post in this series focused on the importance of understanding the ambitions of HRM software/services vendors and the implications of those ambitions for buyers/investors/employees/the industry. Next came a post focused on the different strategies of these same vendors, the many moving parts that must be addressed in those strategies, and the implications of the differences in strategy for buyers/investors/employees/the industry. Now for the fun part, at least for me — their software!

I’d love to do an individual post on the good, the bad and the ugly of each relevant vendor’s software assets, but for that you’d have to pay me (as clients do) serious money. I’d have to do a ton more detailed homework and then be willing to discuss every word I wrote, seven or eight times each, with vendors who took issue with my writing. As you can well imagine, life’s too short and too full more interesting things to do. And you can figure out all those details by yourselves using my scripted scenario demo process discussed here with with much more here as applied to your particular business needs or areas of specific interest.

So instead of a feature/function/architecture/object model play by play — although I may yet do some version of this — I thought I’d share the list of emerging capability topics that seems to cover much of what I’ve been hearing, seeing, and thinking as I’ve gone through dozens of vendor briefings and demos (and with many more to come) and integrated their perspectives with my own. This is my working list of topics for which all core HRMS as well as the major (as to scope of offering as well as vendor viability) talent management vendors must have a clear strategy and plans for execution. To be viable in my eyes, vendors must have more than a powerpoint on these topics. Vendors must have real product already in current delivery and a lot more to come in 2011 on at least some of these topics as well as a clear strategy and plan for all of them to get high marks in my eyes. But please note that nothing here is a substitute for having true SaaS InFullBloom under the covers (if you’re trying to be a SaaS vendor) or most of the same preferred behaviors even if you’re licensed/on-premise. Good software is a pre-requisite no matter what else is going on, at least in my book.

Without further ado, here’s my list as of 3-28-2011:

1) Mobile — this is not just about taking existing transactions and reformatting them for mobile devises but rather about rethinking HRM, especially talent management (TM), workforce management (WFM), and strategic HRM analytics/decision-making, for a mobile world.

2) Social/Collaboration — which types of collaboration are being built into the platform and then unleashed in what order to what HRM, talent management, and workforce management processes with what intended business impacts? Here too, it’s not just about “socializing” existing transactions or processes but about rethinking HRM from a workforce collaboration perspective.

3) Global — what platform capabilities for what target markets and in what countries backed up by what go-to-market plans and “feet on the street,” to include VARs and other types of distribution relationships? I’m particulary impressed (or not!) by how much of the heavy lifting of regulatory compliance the vendor has taken on for the covered geographies, something which many to most of the talent management vendors have avoided entirely by saying that their customers are ultimately responsible and their configuration capabilities are superb.

4) Analytics — what types of actionable, embedded, and/or predictive analytics with what types of visualizations, e.g. network analyses is becoming quite prominent when organizations try to figure out what roles and individuals have the greatest business impact? And I should emphasize here that this is about getting real insight to decision-makers in a form they can use when they’re in the middle of making that decision rather than just having a wonderful report-writer or business intelligence solution with which they can figure out the questions and search for the answers.

5) Embedded intelligence of all kinds — what is the vendor really doing to deliver, “out of the box,” the type of content, guidance, exogenous data, “best” practice processes and business rules, without with self service is really distributed data entry? If Amazon can tell me what I’ve been reading, what others who read what I read are also reading, and the status of every open order almost before I pose these questions, why can’t my TM software tell me which people to hire?

6) Integrated HCM — this is the issue of core ERP/HRMS vendors building out TM like crazy while some TM vendors venture into core HRMS territory (absent payroll and benefits) and it’s on this list because I don’t believe that customers can afford to invest enough in talent management (and not just the technology) if their budgets/expertise/management attention/capacity for risk-taking/etc. is consumed with maintaining legacy core HRMS’ and trying to extend them with myriad add-ons nor can they easily replace those systems of record (SORs) unless there are excellent, lower cost, easily implemented and more comprehensive alternatives.

7) Talent management integration — where this is about having deep process-based and event-triggered integration (so not just UI or reporting integration) across all of talent management with a clear story on what the vendor includes in TM, what they don’t include in TM, what they really have of what they include, and what their plans are via product development, partnering, agnostic integration, for what you don’t have.

8) Integration tools — what capabilities are provided for the inevitable integration needed across disparate HRM enterprise software components, non-HRM but interconnected enterprise software components, various HRM outsourcing providers,etc., to include integration “in the cloud?”

What topics are on your list of general HRM software vendor product direction questions? I’d sure like to improve mine, so please share your thoughts.

- Sunset At Bloom & Wallace HQ

After doing one popular post inspired by the artifacts in my office, I thought I’d do another. This one is based on a very yellowed newspaper clipping (yes, they used to come on paper, which yellowed over time and became quite fragile, not unlike electronic files whose formats can no longer be read). No date remains, and I have no idea who Harry was or is, but his rules are well worth noting:

- Exercise 6 days a week for the rest of your life.

- Do serious aerobic exercise 4 days a week for the rest of your life.

- Do serious strength training, with weights, 2 days a week for the rest of your life.

- Spend less than you make.

- Quit eating crap!

- Care.

- Connect and commit.

Harry’s rules got me thinking about whether or not I had learned any additional life rules that were worth sharing, and I do have a few for your consideration:

8. Philanthropy isn’t about extra credit; it’s an obligation. Actually, this isn’t a rule of my own devising. The Hebrew term is tzedakah, literally fairness or justice. And lest you think that all philanthropy is equal, Maimonides offers a hierarchy of giving, with the first item listed being the most worthy form, and the last being the least worthy. I find it interesting that the most worthy form is to help a person in need to become not only self-sufficient but also to join the circle of tzedakah in their own right, not unlike the later Christian notion of teaching a man to fish. Translated from Maimonides:

a) Giving an interest-free loan to a person in need; forming a partnership with a person in need; giving a grant to a person in need; finding a job for a person in need; so long as that loan, grant, partnership, or job results in the person no longer living by relying upon others.

b) Giving tzedakah anonymously to an unknown recipient via a person (or public fund) which is trustworthy, wise, and can perform acts of tzedakah with your money in a most impeccable fashion.

c) Giving tzedakah anonymously to a known recipient.

d) Giving tzedakah publicly to an unknown recipient.

e) Giving tzedakah before being asked.

f) Giving adequately after being asked.

g) Giving willingly, but inadequately.

h) Giving “in sadness” – it is thought that Maimonides was referring to giving because of the sad feelings one might have in seeing people in need (as opposed to giving because it is a religious obligation; giving out of pity).

9. Your successes are not solely of your own making, so don’t take too much credit for them. As it happens, we are all either blessed or cursed by the good fortune of our birth and by the good fortune, the mazel, that has accompanied our journey to this point. Born in the US? Mazel. Born healthy, intelligent, and loved? Mazel. Wanted by two reasonably together and prepared parents? More mazel. Managed to get through school, university, life-to-date without dread diseases, terrible accidents, loss of your freedom or life in civil unrest? Pure mazel. What you build on top of all that good luck through your own hard work and perseverance is absolutely yours for which to take credit, but it’s important to remember just how much of what we become, of who we are, and of what we have is just plain dumb good luck. Thinking about life this way, as a three-legged stool of which you only control one leg, makes clear why tzedakah is an obligation for those of us whose stools have three good legs.

10. When in doubt, reboot. This really started out as when in doubt, trim your sails. One of the first lessons that every sailor learns is that, when you first think the wind is kicking up, it’s time to reef (shorten) your sails. It only gets harder and more dangerous to do so as the winds get stronger, so it’s best to reef early. Then, if the winds ease, you can always unreef those sails. Not sure about the significant other in your life? Don’t race to the alter. Not sure about the fit of a job offer? Sleep on it. Uncomfortable about the economy, about the markets, about your own financial future? Hold cash, spend less, work more. Computer behaving oddly — and when don’t they? — reboot. When I was leaving for college, my father, who was more of a buddy than an advice-giver, offered me the following advice when it came to dating: “If the boy makes a move with which you’re not comfortable, think about it overnight. No boy will say no if you call him the next morning to accept his offer.” When in doubt, reboot!

11. Life is short, fragile and amazing; live large. Several of my closest friends never made it through college. Horrible accidents, Viet Nam, and more ended their lives before they could drink legally. My Mom died before her 40th birthday as did two of my very closest friends from childhood. And the list goes on. I really do believe that we should pack two years of living into every calendar year, working hard, playing hard, making time for friends and family and ourselves. Ron and I travel a ton, try to find time for boating, and are already planning how we’ll spend big chunks of 2013. G-d willing (now we’re back to mazel) we’ll “live long and prosper” and be the life of the party at the old farts home.

Note: If anyone knows Harry, please thank him from me for his rules to live by. Also, I’ve called this part I just in case Harry steps forward with more.

Sex Sells! For reasons too complicated to explain, even to myself, I’ve been doing a lot of clearing out of the “underbrush” in my office over the last couple of weeks. Some of this was absolutely essential because the physical piles of papers that will never be read, the files of long gone clients, the insights notes whose sources are lost in the mists, and all the other detritius of a busy professional life that started way before it was possible to go all electronic were propagating. I could no longer find quickly the really important things, and every available inch of my very generous counters were overflowing.

But some of this clearing out was also about clearing out the “underbrush” in my too full brain to make room for new ideas, people, vendors, clients, deliverables, object model considerations, etc. Your brain may be much younger than mine and, perhaps, less full, but I know that there’s no more room in mine unless I periodically delete and defrag.

The best part of these periodic clean-outs are the gems I find lurking at the bottom of folders or tucked into a pile on some totally unrelated topic. This particular gem is the set of 3×5 cards (do they still make them?) I used for a speech I gave at then HRSP’s (predecessor to IHRIM) national conference in 1992. For those of you too young to remember the reengineering craze, just substituted the latest equivalent — tranformation! Direct to you from across the decades are these words to live by, exactly as they are hand-written on those 3×5 cards.

-

Everybody’s talking about it;

-

Few are really actively engaged;

-

And very few are really best-in-class;

-

It’s hard to do well;

-

It’s so easy to find an excuse not to get started;

-

There are no performance standards and failure to perform (once you get started) is ego-threatening;

-

We start with good instincts, but they’re “discouraged” by our training;

-

So what are we to do?

PRACTICE MAKES BETTER! There’s no substitute for experience. But make sure you obtain informed consent up front.

Note: Michael Hammer’s seminal 1990 article in the Harvard Business Review was the launch point for this management concept, for reengineering, and I was an early adopter for HRM and the HRM delivery system. He was younger than me and died way too young in 2008, but I think he would have loved the use to which I put his concepts in my 1992 speech.

- Show Me The Money!

In my last post, I wrote about one aspect of the way in which I look at and learn about the HRM software vendors and outsourcing providers with whom I’ve been meeting over the last few months, namely their ambition as businesses. In this post I want to take up another important aspect of that same topic, what I’ve been looking at and learning about the competitive context in which these vendors/providers operate. No surprises here, and it’s something I’ve written about before in briefing select clients, but I thought it might be helpful to the larger community to collect these thoughts in one place.

Since 1967, I’ve witnessed and participated in (leaving fingerprints along the way for all to see and evaluate) more generations of HRM software than almost anyone reading this post. However, the generational change now underway — quite far along actually, in case you and/or your vendors aren’t with the program — is far more complex than those that have preceded it. We’ve had many changes in underlying technologies (e.g. mainframe to client server to native Web to cloud), we did a very big move in business model when we went from custom development to the use of packaged software, and we’ve certainly had several generations of how we build software, from “arts and crafts” to software engineering to agile and more, but there’s a lot more going on now and over the past five to ten years than just these types of changes.

What makes this such a challenging time for all HRM software vendors and service providers is that their business strategies, in order to remain relevant and be successful, must now address many fundamental areas of change in the enterprise software business that are happening at the same time. That doesn’t mean that every vendor/provider needs to incorporate every single change that I describe below within their business strategy. But it does mean that, at a minimum, they must make clear business decisions about how they will address or not address each category of change and then weave those decisions into a coherent business strategy, along with all the other elements of strategy like nature of products/services, target markets, distribution methods, etc. etc. From the perspective of market influencers and buyers, understanding how each vendor/provider addresses these sea changes in the enterprise software business provides enormous insight into their likely success, even viability, in today’s market.

So what are these changes, and why do they matter? Here’s my take:

- Business models — from licensed to subscribed — and while this change and the pace of this change differ by geography/specific industries, subscribed is strongly preferred now in many to most new deals by buyers of HRM software/services buyers and by industry investors because it removes a very large and up-front capital expenditure in favor of a usage-based, ongoing expense. And while there may still be quite long contract lengths and up-front prepayment in order to secure advantageous pricing, great HRM SaaS vendors are able to create enough stickiness in the desire for the products and enough elegance in their sales through implementation processes to enable rapid and not unreasonable costs in the run-up to full production to move themselves and their customers into that productive, recurring revenue phase of the relationship and then keep them there with very low cost-to-achieve renewals — or so goes the expectation by buyers and investors and market influencers.

- Deployment models — from on-premise or 3rd party hosted to vendor hosted (ideally, in the cloud) — this change and the pace of this change also differ by geography/specific industries, but vendor hosted, ideally with the industrial strength and improved costs of the cloud, is preferred strongly in many to most new HRM software/services deals by buyers and absolutely by industry investors. From a buyer’s perspective, while there remains a key role for IT to play in the evaluation/selection/implementation (especially as regards putting any new applications into the larger and interconnected landscape of systems supporting that buyer’s organization, there’s no need to impose unduly on the always challenged infrastructure resources of their own organization. Need a sand box to evaluate and the implement a true SaaS solution? It’s provided by the vendor. Need two production tenants, one that’s physically in Europe to head off privacy concerns until such time as the underlying policies can be revised? It’s provided by the vendor (assuming you’ve selected one with global capabilities). Need to ramp up production capacity quickly to handle the launch of a new business or an acquisition? It’s provided by the vendor. Pretty sweet when you consider how low on the list the HR function can be when requesting rapid IT attention.

- Architectural models — from customized single to configured multi-tenant — not only is this essential to cost-effective, rapid time-to-market and time-to-revenue, and scalable operations for subscription/hosting by vendors, but it also opens up a whole range of new revenue sources, from selling aggregated analytics to 1-to-1 marketing. This is a particularly contentious area, and there are clearly situations and buyers that don’t lend themselves to multi-tenant configuration only, true SaaS (not to mention a gazillion customers already in the installed bases of legacy lincensed/on-premise/single tenant HRM software vendors), but the momentum does appear to be on the side of these newer architectural models because the offer the ultimate range of productive options for both buyers and vendors. Vendors can host and subscribe whatever they’ve got, often doing so and calling it SaaS. But doing so beggars their future in an industry where the many benefits of true SaaS will only accrue to those vendors who have it and to their customers.

- Software development models — from procedural to models-driven — Workday is a good example within our industry of the improved time, quality and cost-to-market this approach delivers once the foundation tools are built/tuned (and these aren’t growing on the commercially available bush yet) and assuming the foundation object models are right and stable. More importantly, those advantages are cumulative, providing considerable leverage as each new release is built on the last one. Workday is by no means the only example of this and there’s a lot more coming. This is one area where I have to keep my mouth SHUT as to who’s doing what, but any vendor who’s not looking deeply into these capabilities is going to wish they had done so by now. One reason why this has been the holy grail of computing for as long as I can remember is that it eliminates one of the most confusing, error-prone, costly and time-consuming steps in bringing new functionality to market, which is translating the always imperfect verbal and text requirements for product into the procedural logic of program code. By capturing those requirements within the models themselves and then letting those models be the application, much less is lost in the translation.

- User experience — from self service as an add-on, transactional/data entry-style and PC-based to consumer-like self service as the only/primary service, with considerable embedded intelligence and increasingly mobile, social, multi-media, we’ve seen the consumerization of HRM software and services. And while I’m hot damn on a keyboard and always will be, many to most of my younger colleagues, not to mention those workers who are always on the fly, are finally getting HRM delivered to them when and where they need it. Even more important is that, with sufficient embedded intelligence within the HRM user experience, we really can unleash more complex and strategic HRM interactions without everything having to pass through the hands of the HR department (or even its call center surrogates) without sacrificing the quality, timeliness, completeness and risk-mitigation of those interactions.

- Buyer responsibilities/behaviors — IT and business leaders play very different roles in true SaaS selection/use, with senior line business leaders taking even more control of strategic HRM software decisions, and there’s far more SaaS available on a try before you buy basis, but I believe that the interrogatory configurator approach will be the turning point for a total rethink of the whole buying cycle and process. While it’s entirely possible to get into production more quickly and less expensively with true SaaS, there’s still a lot of heavy lifting — or their should be — to be done by HR leaders to clean up years of crummy data structures, refactor codes for a more modeled environment, get serious about competency-models however socially developed, and much more in order to get full value from at least the more strategic HRM software coming as SaaS. And inserting new software, SaaS or otherwise, into the existing systems landscape takes some serious rethinking of all those interfaces and integrations, with smart buyer/IT partners working hard to reduce the number and complexity of such interconnections.

- Buyer influencers/influences — from a few major (which vary by market and HRM process) professional organizations, print journals, vendor conferences, traditional analyst firms and HR tech conferences to a host (glut?) of bloggers, Webinars, in-person and physical HR tech conferences, Twitter streams, new-age analyst firms/centers of influence, and vendor conferences, etc. — making your voice heard through the general din is much more challenging and has reshaped/is reshaping vendor marketing to be more social, relationship-based, multi-media, integrated, guerilla, and substantive. The very fact of my having a blog on which I can write this post tells you everything you need to know about what’s happened in the marketplace of ideas surrounding HRM software and services. Vendor marketing teams not only have to get their messages across to the “official” analysts and influencers, but they have to monitor and participate in a huge array of forums in which their products and companies are discussed. If you’ve been following one of the best of these, the HR Technology Conference discussion group on LinkedIn, you know how pointed can be those discussions and how much influence they generate.

- Green field versus replacement deals — almost all US companies of any size as well as many to most around the world have some level of automated HRM support. Those with more than 500 workers usually have some form of HRMS, but often with outsourced payroll processes, and at least some strategic HRM functionality, either via their HRMS or via talent management software add-ons. For most companies of any size, it’s no longer just about getting the payroll done and avoiding compliance woes but rather the needed to deploy a productive and engaged workforce. As a result of 40+ years of automating at least payroll, many to most of today’s and tomorrow’s HRM software/services deals are replacing some earlier form of automation, if only spreadsheets and user-developed databases. And buried in all that prior automation are the crummy data structures (anyone remember when we were limited to 80 character records?), worse coding structures (the ubiquitous employee status code into which we threw everything but the kitchen sink — but surely that was killed off a couple of generations ago?), important historical data that must be brought forward or which will require us to maintain old systems just so we can access old data, and myriad other implementation issues that must be addressed as we move forward in a way that doesn’t drag the past along to hobble our future.

- Sales/implementation models and timelines — more than in any time I can remember, and its axiomatic in the case of true SaaS because of the very different business model, there is tremendous pressure on vendors to: (1) shorten initial elapsed time/cost to customer and vendor value — consider impact of channel partners and interrogatory configuration, (2) absorb most of the cost, and not get subscription revenues until customer is in production — significant accounting issues here for revenue recognition, etc., and (3) shorten continuously the elapsed time/cost to value as vendor rolls out new releases and/or customer needs change. I’ve noted above the architectural foundations, interrogatory configuration and models-driven development being two of them, for addressing this particular strategic challenge, but there’s a lot more dimensions to this particular challenge that can’t be addressed solely by software design. The competency profile of our best salespeople for licenses/on-premise enterprise software, and the incentive compensation plans and other HRM policies that drove them to achieve the needed business results, must all change for true SaaS. On some level, there’s the opportunity to eliminate much of what traditional enterprise software sales people, and pre-sale consultants, do, replacing it with marketing that reaches beyond HR, freemium software trials, and interrogatory configuration to move prospects through implementations.

- Growing ownership by private equity firms — and, in some cases, for longer periods of time — but with wildly different investment philosophies: (1) invest, turnaround, grow, operate, return profits, but this is rare, (2) dress up and flip in a few years, (3) milk a maintenance/subscription revenue stream, doing just enough to prevent customers from absorbing the pain of moving, and (4) longer horizon but not operators. Where once a floundering HRM software vendor either went out of business or was bought for its installed base and/or maintenance stream by one of the software graveyards/aggregators, the presence of private equity firms allows for some very different scenarios in terms of both maintenance stream milking or investing for growth/renewal. Many very capable and growing HRM software and services firms are owned entirely by private equity firms, using new capital provided by these firms to seize opportunities that they just couldn’t do on their own. On the other hand, there are also firms in our industry whose private equity owners are doing quite the opposite, squeezing all investments to reap maximum short-term profits.

- Growing consolidation — many factors at work here, not least of which is the emergence of true SaaS puting pressure on vendors: (1) to achieve the scale/new markets needed to support fixed cost aspects of the business and deliver the growth/margins needed to support IPOs and/or (for already public companies) desired stock prices/multiples, (2) to buy growth as a cover for their inability to achieve sufficient organic growth and/or to support the increased investments needed to re-architect for true SaaS, and (3) to re-architect, not just for multi-tenancy but also to address newer/less costly development approaches, rising customer expectations re: mobile/social/richness, increasingly global (or at least multi-national) customers, new and/or evolved competitors, etc. Many of us have questioned the high G&A spends of some of the most visible and rapidly growing HRM software vendors, but if you believe that true HRM SaaS is a consolidating landscape wherein there will only be a very small number of vendors left standing in each important segment, then a “land grab” and huge R&D investments may make more sense than trying to increase profits substantially in the short-term.

I believe that we’re at a major industry inflection point, not only about taking advantage of new technologies but also about changing business models and deployment options. In my view, many existing HRM software vendors will not be viable/independent in 2-3 years unless they are able to adjust quickly enough to all of these changes. There’s also a ton of consolidation going on in specific BPO domains, like payroll service bureaus, background checking, assessments, PEOs, benefits administration, etc., and new types of SaaS-based BPO are emerging/growing. Some of today’s vendors/providers will do very well indeed under a new set of business, technology, deployment, etc. models, but many more won’t, and the items above constitute a pretty good checklist for assessing that viability.

If you’re a vendor, you may want to consider how well your stated (real?) strategy addresses the contextual changes I’ve noted above — and there are myriad variations on all of these changes as well as myriad effective means of addressing them — and be sure that you can explain during briefings how your strategy approaches each of these areas. If you’re a buyer/end-user, be sure that your vendors are truly on top of these changes and that your firm’s needs are a good fit for the direction your vendors are taking on each of them.

Boy, what started out as a short post on this subject got right out of hand, but that seems to happen to me with some regularity. Guess I’m just not a sound bite kind of blogger.

- When I Could Still Climb Mayan Pyramids

Many of you know that I’ve been doing a ton of briefings/demos with HRM software and services vendors this quarter, with many more to come. So let me start this post with a major shout-out to all the vendors with whom I’ve met and will be meeting for their time, their preparation, and their courtesy. I know that it’s a major draw upon vendor leadership time to keep all we so-called influencers informed about their business, their products/services, and their industry perspectives, and I for one am very grateful to everyone involved in these briefings. Hopefully I’m giving as good as I’m getting so that their time is as well-spent on these calls as is mine.

One of the questions I always ask vendors, as context for learning about their business and products/services, is “what is your ambition?” Ambitions for organizations change over time, and they should do so as competitive, industry and organizational changes argue persuasively for such changes. It’s a wise leader who is realistic about what it will take to realize their ambitions and the extent to which their assets are sufficient and a good fit for doing so.

Within the HRM software/services industry, we’ve got leaders with enormous ambitions in whom we have confidence of their achieving them because they bring so much to doing so in terms of experience/track record, financial resources in hand or easily obtained, and tons of talented people ready to follow them wherever they lead. And then there are those leaders in our industry who have squandered their assets, damaged the talented people who found themselves working for them, and never come close to realizing their ambitions because of their own fatally flawed KSAOCs and decisions — and their inability to adjust their ambitions to fit their capabilities.

And then there’s Naomi. One ambition I had personally and did achieve before my legs stopped working well enough to do it (which adds the dimension of timing, because ambitions must evolve to meet the current reality, or at least they should) was to climb a number of the more remote Mayan pyramids. Professionally, one ambition I set for myself in 1987 when I started my solo practice was to help change the practice of HRM from a focus on administration with an emphasis on labor cost control and systems which were basically file cabinets and payroll calculators to a focus on achieving business outcomes via integrated strategic HRM processes enabled by systems that managed KSAOCs as their core, with all that implies. I know that I wasn’t the only voice pushing for these changes, but I will take a tiny bit of credit for the fact that most of today’s HRM systems are KSAOC-centric, focused heavily on enabling strategic HRM processes, and very much attempting to drive business outcomes via improving workforce decisions. Climbing those pyramids and seeing my fingerprints on a good bit of today’s HRM software are two ambitions realized, each in their own time and each requiring me to make fundamental choices about what I would do and, VERY importantly, what I would not do in using my own limited resources and KSAOCs to achieve my ambitions.

This is why I’m so interested in each vendor’s ambitions as a backdrop to learning about their strategies, products/services, target markets, etc. etc. Those ambitions really matter when you evaluate a vendor’s viability, their likelihood of acheving those ambitions, as you look at their organizational assets, their bench strength, their software assets and services infrastructure along with their intellectual property. Successful organizations are those whose assets are sufficient to realize their ambitions — how obvious is that! — but it’s always amazing to me how many organizations (and people!) are out of sync on this point. And if you’re a buyer of HRM software/services, you’d better keep a very careful eye on this point to ensure that, as they pursue their ambitions, your vendors are serving yours.

What may be less obvious is that, within our industry, there are generally three very different patterns of organizational ambitions. These patterns do vary for a given organization over time — and they should — because smart leaders, as noted above, evolve their ambitions along with reality. However, these ambitions also evolve because businesses that are failing to achieve one set of ambitions may well set their sights differently when faced with that reality. The three major patterns of organizational ambitions that I’ve seen are:

- Lifestyle businesses — these are businesses which are founded or run to support the modest to affluent financial needs while fulfilling the professional passion of their founders or leaders. Bloom & Wallace is a good example of this where my professional passions are well-known. What’s less well-known is that I’ve stayed a solo, in spite of opportunities for much greater wealth, so that I could (1) work with many more industry players in an impactful way than I could have done by working with just one industry player, (2) focus exclusively on my clients without the obvious creative tensions of supporting a whole consulting enterprise, (3) accommodate my husband’s career, which was in the Washington, DC area for 22+ years, which isn’t exactly a hotbed of HRM software/services HQs, (4) build/license/support a body of intellectual property that is vendor neutral but influencing widely the current and next generation of HRM software, (5) travel widely when and where we choose with only the need to plan far enough in advance so as not to disrupt client projects, and (6) adapt to the needs of my aging body. There are many such HRM software and services firms, making money for themselves and their investors (where they have investors), providing often quite wonderful work environments for their staff, and contributing mightily to our industry — and they aren’t all small. For the customers/clients of these firms, they’re often a great pleasure with which to do business, can be quite innovative and agile, and rarely have unhappy customers because they couldn’t survive if that were the case. But it’s also rarely the case that, at least among HRM software/services companies, major end-user organizations are well-served by having a lifestyle vendor at the center of their HRM delivery system except where these founder-led vendors are mophing into a form which will survive and prosper beyond the founder’s tenure. When Bloom & Wallace finishes a client engagement, we’re off that client’s critical path and aren’t responsible for their HRM service delivery foundation. From the perspective of product/service buyers, you may not want to be unduly dependent on a lifestyle vendor unless they and you are prepared to accept the risks of their inevitable adoption of one of the other two ambition patterns or the ending of their business.

- Built to be bought businesses — these are businesses, often founded by serial entrepreneurs with their own or investor money, which fill an opportunistic niche in our market, innovate in an underserved area, find a need and fill it. But, unlike the run/grow/dominate businesses, the built to be bought businesses usually don’t take on a scope of product or services which is large enough, by itself, to generate the type of return that the investors may require or to which the founder aspires via an IPO nor with a large enough and sustainable enough niche to simply grow and profit their way to those wanted/needed returns. Successful businesses of this type — and they are legion in the IT world and within our own HRM software/services industry — know from their early days who their likely buyers are, what those buyers value, and how they can develop enough interest from enough buyers to achieve the desired multiple when they do sell. And while some such businesses are started with this ambition from day one, many more start out as lifestyle businesses which turn to buyouts as their founders/owners want liquidity, retirement, or just out. From the perspective of their customers, knowing that your vendor is going to be bought is VERY important for your own planning. Are you okay with having your contract now serviced by a much larger vendor, perhaps one which you didn’t select in the first place? One which may force you off of the software/services that you chose and onto something else? Or perhaps one that will save you from a dying product, replacing it with their much more survivable one? Whatever the case, there’s disruption ahead, even if the outcome is a very good one. And knowing that your vendor/provider is likely to be bought helps you decide where you’re willing to use such vendors within your HRM service delivery.

- Built to run/grow/dominate businesses — and then there are the businesses that are started with the clear and stated intention of being grown and run to dominate an important industry segment, and one that’s big enough to offer them almost limitless possibilities in terms of revenue and profitability. These are the businesses whose founders, at least in our industry, are redefining how we think about a major market segment, how products/services are built/sold/delivered/priced/etc., how we think about HRM and the HRM delivery system. Now that doesn’t mean that these ambitions are always realized — they most often aren’t — but when combined with the right assets, these are the ones to watch over the long run. And these are the ones on whom we want to bet for our core HRM delivery system platform. Some to many of these firms go public (hopefully when they’re big enough and with sufficiently industrial strength internal processes not to be overwhelmed by the demands of being public), and some remain incredibly successful but privately owned, but businesses with this ambition become the very backbones of our HRM delivery systems. From a buyer’s perspective, you rarely get leading edge capabilities for the core components of your HRM delivery system unless you jump on board with one of these vendors when they are themselves early days, and that means being an early adopter. Once these companies have achieved their ambition, it’s very hard for them to remain as innovative, as agile, as aggressively focused on their customers’ success as they did when they were hungrier, but by then they become the “safe” choices for buyers who aren’t early adopters. And sometimes these very same vendors, having grown large and successful, surprise us by delivering their own next generation of products/services.

There’s no such thing as a correct ambition, but there are viable combinations of ambition and assets. Do you know the ambitions of all of your HRM software /services vendors? Do you know how well they are doing against those ambitions? How good a fit are their assets for achieving those ambitions? Have you matched the ambitions of your vendors, presuming that they are moving toward achieving them successfully (because you certainly don’t want to rely on vendors who are failing to do so), to the role that their products/services play in your HRM delivery system? Have you bet the farm on a vendor’s failed (or likely to fail) ambition to run/grow/dominate the HRM delivery system platform? Does one or more of your talent management “best of breed” vendors fit the profile of built to be bought, whether deliberately so or because they’ve failed as a run/grow/dominate business? Just as I want to understand the ambitions of the vendors/providers with whom I’m taking briefings so that I can look at their products/services etc. against that backdrop, so too should buyers of these products/services take a hard look at the fit between what they need and what they vendor/provider’s ambition will lead them to deliver. Ambition does matter!

Carnac the Magnificent When we lost Johnny Carson, we lost a great entertainer. For thirty years, 1962 to 1992, he dominated late night television, and he did that without insulting our intelligence or our sensibilities. My beloved grandmother, Bubbi Bloom, with whom I lived through much of high school, would get ready for Johnny’s Tonight Show by putting on a lovely nightgown and robe and freshening her hair and makeup. And no matter how often we told her that he couldn’t see her, she was unconvinced. Prove it, she would say, to which there simply wasn’t an adequate answer.

One of Johnny’s best-loved characters was Carnac the Magnificent. I’ve often used Carnac in my work, pretending to be him, when confronted with the unknowable, the unanswerable, the irrational questions for which no reasonable responses are going to solve the problem. Unfortunately, as I age but my clients don’t, more and more of them haven’t a clue about Carnac and just think my little skits are wierd. Such is life.

So why is Carnac showing here, and now? Well, there have been and will be many more blog post predictions (including my own recent post about likely vendor consolidations) about what’s going to happen in 2011 in human resource management (HRM), in HRM technology, in HRM BPO and in the HRM delivery system. Some of them may even prove correct when we look back at the end of this year. But what all of us would really like to know aren’t the answers to the known questions (whose answers are already in process) but rather how we should prepare for the unknown questions (those questions which just haven’t presented themselves yet). And that was Carnac’s great gift. Hhe was able to discern the answers to questions hidden in the proverbial “the envelope please” just by holding that envelope to his forehead, thus engaging his powerful brain.

With many thanks to Johnny Carson for his contributions to my education, here’s my attempt at answering the unknowable questions that will confront our industry in 2011:

- Answer: None.

- And the question is: How many “fake” SaaS HRM software vendors will be on a trajectory to achieve $250 million in annual recurring revenue from their HRM software (because some may offer more than HRM) with 25% real margins by the end of 2011?

- Answer: No.

- And the question is: Will Lawson retain its current leadership, ownership, product mix, and/or non-SaaS HCM product strategy by the end of 2011?

- Answer: Very few.

- And the question is: How many full-scale, global implementations in organizations with more than 5,000 workers will there be by the end of 2011 of Oracle Fusion HCM where the losing vendor is anyone other than Oracle PeopleSoft or EBS HCM?

- Answer: Yes.