Speaking Engagements UPCOMING

Predict and Prepare sponsored by Workday 12/16

PAST BUT AVAILABLE FOR REPLAY

The Bill Kutik Radio Show® #171, 2/15

The Bill Kutik Radio Show® #160, 8/14

The Bill Kutik Radio Show® #145, 1/14

Workday Predict and Prepare Webinar, 12/10/2013

The Bill Kutik Radio Show® #134, 8/13

CXOTalk: Naomi Bloom, Nenshad Bardoliwalla, and Michael Krigsman, 3/15/2013

Drive Thru HR, 12/17/12

The Bill Kutik Radio Show® #110, 8/12

Webinar Sponsored by Workday: "Follow the Yellow Brick Road to Business Value," 5/3/12 Audio/Whitepaper

Webinar Sponsored by Workday: "Predict and Prepare," 12/7/11

HR Happy Hour - Episode 118 - 'Work and the Future of Work', 9/23/11

The Bill Kutik Radio Show® #87, 9/11

Keynote, Connections Ultimate Partner Forum, 3/9-12/11

"Convergence in Bloom" Webcast and accompanying white paper, sponsored by ADP, 9/21/10

The Bill Kutik Radio Show® #63, 9/10

Keynote for Workforce Management's first ever virtual HR technology conference, 6/8/10

Knowledge Infusion Webinar, 6/3/10

Webinar Sponsored by Workday: "Predict and Prepare," 12/8/09

Webinar Sponsored by Workday: "Preparing to Lead the Recovery," 11/19/09 Audio/Powerpoint

"Enterprise unplugged: Riffing on failure and performance," a Michael Krigsman podcast 11/9/09

The Bill Kutik Radio Show® #39, 10/09

Workday SOR Webinar, 8/25/09

The Bill Kutik Radio Show® #15, 10/08

PAST BUT NO REPLAY AVAILABLE

Keynote, HR Tech Europe, Amsterdam, 10/25-26/12

Master Panel, HR Technology, Chicago, 10/9/012

Keynote, Workforce Magazine HR Tech Week, 6/6/12

Webcast Sponsored by Workday: "Building a Solid Business Case for HR Technology Change," 5/31/12

Keynote, Saba Global Summit, Miami, 3/19-22/12

Workday Rising, Las Vegas, 10/24-27/11

HR Technology, Las Vegas 10/3-5/11

HR Florida, Orlando 8/29-31/11

Boussias Communications HR Effectiveness Forum, Athens, Greece 6/16-17/11

HR Demo Show, Las Vegas 5/24-26/11

Workday Rising, 10/11/10

HRO Summit, 10/22/09

HR Technology, Keynote and Panel, 10/2/09

Adventures of Bloom & Wallace

|

Wish This Were One Of Mine! One of my goals for 2013 is to spend more time painting, particularly illustrated journaling. The particular techniques of interest are to do quick, annotated line drawings and/or watercolor sketches of whatever takes my fancy as we travel/play/go boating/whatever within an easily portable bound journal. I also want to try creating drawings that I can use to illustrate my blog, but I think that’s further up the learning curve.

In the meantime, I signed up for two watercolor classes this “season,” (with our greater winter population, there’s a ton of cultural/education opportunities concentrated in that period), hopeful of improving my knowledge and mastery of technique, my watercolorist KSAOCs. This is clearly taking me outside my comfort zone, and that’s a good thing even if it’s a humbling experience.

One unexpected side effect of taking up watercolors, for which I have neither background nor aptitude, is that I’m seeing much more subtlety of color in our sunrises and sunsets. Fort Myers is awash in color during our magnificent sunrises and sunsets, and I so wish I had the talent to capture them in watercolor.

How are you doing with your own explorations into unknown KSAOC territory? Are you at the “I’m not going to be good at this” stage? I’m well past that and into the “I’m never going to be good at this but I’m really enjoying it” stage, and my instructor tells me that, even with a late start and limited tuition, I’m making real progress.

Something else I’ve learned (besides seeing everything and everyone around me as a potential subject) is that knowing what it takes to do something makes it easier to spot/attract/deploy/reward/etc. talent with those KSAOCs. I wasn’t pleased with the first couple of instructors I had, but I lacked even the vocabulary for describing what I wanted from them that I wasn’t getting — and what I was getting that I didn’t want. As my KSAOCs grew, I “fired” those instructors and found one that had the right KSAOCs. Now I know what to look for, and I can recruit more instructors with more confidence of their fit for that role.

Learning to paint for me has been just as challenging as learning to make sound #HRTech decisions is for HR leaders. Real learning doesn’t take place until you open yourself up to it, lower those “I can’t/won’t/don’t want to/etc.” defenses. I’ll never be a master watercolorist unless I throw myself into that full-time AND discover some innate talent. And HR leaders will never be masters of #HRTech unless they do they same — and that’s probably not the best use of their time. But I now have a better appreciation of great works of watercolor, and I see the world with an artist’s eye. That’s just what HR leaders need to learn re: #HRTech. I hope I do as good a job of bringing to HR leaders an appreciation of and the best approaches to #HRTech as my watercolor instructor has brought to me when it comes to painting.

There are lessons in strategic HRM lurking behind every personal KSAOC expansion journey. Learn those lessons to advance your HR leadership. And stay tuned for more on my own KSAOC expansion journey.

It’s Good To Be Queen! I’ve been feeling quite optimistic lately about the state of HR technology, which is quite a good feeling. For most of my career, I’ve been frustrated by less than great software and less than great adoption of the best available software, but now there are multiple reasons for optimism on both fronts.

First, I see several vendors moving and/or trying to move in the direction of true SaaS InFullBloom, complete with proper object models, increasingly modern architectures, and real vision around the changing nature of work and workers. There’s a lot of heavy lifting here, to include a ton of refactoring for those vendors without the luxury of starting over, but it’s reassuring to know that the architectural and object model ideas I’ve been promulgating for far too long are widely accepted now. although not entirely by vendors whose business interests lie elsewhere.

Second, I see more end-users making the outcomes-based business case for moving to this new generation of (or substantially refactored) HRM software, having the courage to leave the familiar behind in order to secure greater innovation, agility, strategic functionality, administrative savings, and more as part of their ROI. It’s been many years since investments in HR technology could be justified — or should be justified — on the basis of improvements in TCO, let alone headcount savings. Now the clear business case for replacing legacy HR technology isn’t just about TCO but about business agility, process innovation, improved decision-making via embedded analytics, and so much more. The leaders have moved from TCO to TCBO, and there’s no going back.

Third, I see our industry not just talking about but actually unleashing the power of embedded analytics to improve business outcomes through improved HRM decision-making — and getting those analytics right to the people making those decisions where and when they’re needed. Of course much hard work remains to be done, that is figuring out what analytics, calculated exactly how, and embedded precisely where, to drive which types of outcomes via specific decisions. But I’m hopeful that, with so many vendors, consultants and end-users focused on these questions, progress is being made.

Fourth, I’ve gotten to know a lot of terrific HRM software architects and product strategists, really the next two generations of same, who deserve a huge shout-out for making real strides in building new or refactoring toward object-based, metadata-rich, definitionally-develped HRM software. Not only is this remedial architectural work (for those without a clean slate) very demanding intellectually but it also requires rigorous yet agile project methodologies and sustained management investment, which is something not all managements can handle. And while I don’t always appear to be as sympathetic as some might wish about the many competing pressures under which these architects and product strategists operate, I really do know how difficult it is to sustain a multi-year architectural development effort when the sales force is screaming for specific features now, senior management answers to private equity or public company financial analyst folks who don’t appreciate the underpinnings of great software, and customers haven’t unleashed most of what you’ve already delivered.

Fifth, as I look at the best of HRM enterprise software that’s already in the market or will be delivered through 2013 and beyond, I am encouraged by the innovation at the edges of HRM, where innovation comes a little easier as does adoption when you’re not unraveling your core HRMS/TM foundations. But I’m even more encouraged, and it’s the real source of my optimism, by the next generation of those core HRMS/TM foundations. Yes, there are a million reasons for organizations to avoid unraveling their Rube-Goldberg HRM delivery systems, to avoid the disruption of rethinking their long outdated data and process designs, to get one more year (or many more) out of the sunk costs of that licensed/on-premise software, and to cling to familiar vendors, technologies, and more. And many of those reasons lie in the resumes, the self-interests, of the HR and IT folks who have done very well with their deep knowledge of Lawson, PeopleSoft, SAP, Oracle EBS and many other successful HRMSs. But if there’s one thing I have learned over a long career, it’s that late adopters in a career sense are no better served than late adopters of technology.

Contraindications: Lest you think that I’m on some new drug, let me just say that everything I’ve written above applies to a small number of vendors/products/customers/etc. The vast majority of what goes on in our industry, if I were to dwell on it, would depress the hell out of me. But let’s not go there. For just this one post, let’s focus on the very real progress being made in some quarters and take pleasure in every bit of progress along the road to nirvana. There’ll be lots of other opportunities to nail the zombie vendors, call out those products with archaic data designs, note where an aggregator has put a thin veneer of integration over their conglomeration of piece parts, shine a light on retro HRM policies and practices, and get into all kinds of trouble doing so. But for now…

The Bottom Line: “When the sky is a bright canary yellow, I forget every cloud I’ve every seen…” Cockeyed Optimism

Show Me The Money! [After many vendor briefings in Q1 2011, I published a series of blog posts summarizing my reactions to those briefings which really captured, as of then, how I evaluated vendors and their products/services. Rereading those posts after a two year hiatus, I was struck not only by their relevance to my current thinking about this topic but also by how much they needed and deserved an update. If you’d like to read the originals, they can be found here, here, here, here and here. But I hope you’ll be more interested in my current thinking because two years is a lifetime in our neighborhood at the intersection of HRM and IT.]

My first post in this reprised series focused on the importance of understanding the ambitions of HRM software/services vendors and the implications of those ambitions for buyers, investors, employees and the industry. The second focused on the different strategies of these same vendors, the many moving parts that must be addressed in those strategies, and the implications of the differences in strategy for buyers/investors/employees/the industry. In the third reprised post in this series I focused on some of the most important capabilities of vendor/provider software, always assuming that what you can’t see is as elegant as what’s visible. Now it’s time to wrap up this series with some final thoughts.

Although I’m painfully aware of how little I know and try hard not to suggest more knowledge than I have, one question I get all the time, via DMs on Twitter, via LinkedIn messages, remember email?, etc., is what impresses me about HRM vendors/products? What makes me think highly or not about the people with whom I’m meeting, their companies and their products/services? And why do some companies seem to get more of my attention and/or favorable opinion than do others? Putting aside those who accuse me of nefarious intentions and with a forthright acknowledgement that I know much more about my vendor/provider clients and their products/services than I do about others, let me try to answer that question here.

Well the first thing to say is that, as a solo consultant and definitely not a professional analyst, I simply cannot follow all the potentially wonderful HRM software and services companies out there. So the fact that I’ve never taken a briefing with your firm or with your favorite vendor should not be construed as meaning anything other than I just don’t have enough time to go around and still do my day job. That said, I tend to pay attention not only to the obvious suspects, to the larger and more extensively used HRM vendors/products/services, but also to the interesting, the clever, the latest undertaking of long-standing and valued colleagues, to other people and vendors who capture my attention by what they do and how they do it.

And suggestions for this latter list come at me from every direction. But I can tell you right now, for the record, that if a company of which I have no knowledge led by people of whom I’ve never heard reaches out to me via their agency/PR firm with a form letter asking for my time, the chances are close to 100% that I’m not going to make time for them. On the other hand, a friendly note from their CEO/chief architect/product or service visionary/etc. connecting what they do to something of interest to me (and those topics have been written to death on this blog, in my twitterstream and in the LinkedIn discussion group for HR Tech Conference), there’s a very high probability that I’d be delighted to meet you — even if I can’t do it right away — and I’ll certainly suggest other influencers with whom you might want to be in touch.

Returning to what impresses me, top of the list is that I love great software. Well thought-out architectures and object models that scale with volumes, new functionality that improves business results by effecting better HRM decisions and meets expanding geographic requirements, and lots more capture my attention. I value well thought-out UXs which incorporate a high degree of embedded intelligence and are appropriate to and variable with the work a user is doing. Real integration — not just interfaces/unification/single sign-ons/middleware management of the gazintas and gazoutas — of HRM domain model, architecture, processes, analytics, etc. is very difficult to achieve without fully organic design and development, so it’s increasingly rare in our industry, but I so value it when it’s well-done, especially as regards core HRMS and talent management. Also high on my list are solid foundations with clever extensions and clear thinking about the differences between the economic buyer and the real customer. New solutions to old problems capture my interest, but even more so do new solutions before others even grasp the problems. And for anything HRM, systemic effective-dating, to include the entire application, should go without saying. And of course I’m more impressed if you’re true SaaS InFullBloom than if you’ve rebranded your old single tenant, customizable code base.

I also love great people, regardless of their role in our industry:

- Smart, hard-working, disciplined thinkers who are paying or have paid their dues and really know what they’re talking about;

- Folks who are as passionate as I have been about the importance of human resource management in achieving business outcomes, ideally led by an excellent HR function but with or without them as necessary;

- HRM subject matter experts who don’t live in silos but understand and work hard at the interconnections, always with a focus on business outcomes; and

- HR leaders who are the very model of a modern etc.

Above all I value integrity — in people, in organizations, and in products/services. Does the vendor’s/provider’s leaders actually do what they say in their marketing literature? I know that they must focus on the bottom line (just as I do!), but do they believe that delivering great products/services to respected and well-treated customers via a respected and well-treated workforce enriches that bottom line? Nothing’s easier to change than marketing messages and media, but individual and organizational integrity can’t be faked or rebuilt easily once lost. While all of us, and our organizations, live in that grey zone between our ideals and our reality, it’s easy to spot the individuals and organizations who work hard to minimize the distance between those — and these are folks whom I value highly.

That’s pretty much it. But if you have visited Casa de Ranas, also known as Bloom & Wallace HQ, then you also know that I love bold colors, and room for the unexpected, the unplannable. That’s what impresses me. And that’s what I hope we can collectively continue to deliver. Otherwise, why bother?

[After many vendor briefings in Q1 2011, I published a series of blog posts summarizing my reactions to those briefings which really captured, as of then, how I evaluated vendors and their products/services. Rereading those posts after a two year hiatus, I was struck not only by their relevance to my current thinking about this topic but also by how much they needed and deserved an update. If you’d like to read the originals, they can be found here, here, here, here and here. But I hope you’ll be more interested in my current thinking because two years is a lifetime in our neighborhood at the intersection of HRM and IT.] [After many vendor briefings in Q1 2011, I published a series of blog posts summarizing my reactions to those briefings which really captured, as of then, how I evaluated vendors and their products/services. Rereading those posts after a two year hiatus, I was struck not only by their relevance to my current thinking about this topic but also by how much they needed and deserved an update. If you’d like to read the originals, they can be found here, here, here, here and here. But I hope you’ll be more interested in my current thinking because two years is a lifetime in our neighborhood at the intersection of HRM and IT.]

My first post in this reprised series focused on the importance of understanding the ambitions of HRM software/services vendors and the implications of those ambitions for buyers, investors, employees and the industry. Next came a post focused on the different strategies of these same vendors, the many moving parts that must be addressed in those strategies, and the implications of the differences in strategy for buyers/investors/employees/the industry. Now for the fun part, at least for me — their software — in this third reprise of the series!

I’d love to do an individual post on the good, the bad and the ugly of each relevant vendor’s software assets, but for that you’d have to pay me (as clients do) serious money. I’d have to do a ton more detailed homework and then be willing to discuss every word I wrote, seven or eight times each, with vendors who took issue with my writing. As you can well imagine, life’s too short and too full of more interesting thing. But you can figure out all those details by yourselves using my scripted scenario demo process discussed here with and with much more here as applied to your particular business needs or areas of specific interest. So instead of a feature/function/architecture/object model play by play — although I may yet do some version of this — I thought I’d share the list of emerging capability topics that seems to cover much of what I’ve been hearing, seeing, and thinking as I’ve gone through zillions of vendor briefings and demos and integrated their perspectives with my own.

This is my working list of topics for which all core HRMS as well as the major talent management vendors (major as to their scope of offering as well as their vendor viability) must have a clear strategy and plans for execution. To be viable in my eyes, vendors must have more than a powerpoint on these topics. Vendors must have real product already in current delivery and a lot more to come in 2013 on most to all of these topics as well as a clear strategy and road map for all of them to get high marks in my eyes. But please note that nothing here is a substitute for having true SaaS InFullBloom under the covers. Good software is a pre-requisite no matter what else is going on, at least in my book. Without further ado, here’s my list as of 3-31-2013:

- Mobile — this is not just about taking existing transactions and reformatting them for mobile devises but rather about rethinking HRM, especially talent management (TM), workforce management (WFM), and strategic HRM analytics/decision-making, for a mobile world, and one in which the variety of form factors for such devices is exploding.

- Social/Collaboration — which types of collaboration are being built into the platform and then unleashed in what order to what HRM, talent management, and workforce management processes with what intended business impacts? Here too, it’s not just about “socializing” existing transactions or processes but about rethinking HRM from a workforce collaboration perspective.

- Global — what platform capabilities for what target markets and in what countries backed up by what go-to-market plans and “feet on the street,” to include VARs and other types of distribution relationships? I’m particulary impressed (or not!) by how much of the heavy lifting of regulatory compliance the vendor has taken on for the covered geographies, something which many talent management vendors have avoided entirely by saying that their customers are ultimately responsible and their configuration capabilities are superb.

- Analytics — what types of actionable, embedded, and/or predictive analytics with what types of visualizations, e.g. network analyses is becoming quite prominent when organizations try to figure out what roles and individuals have the greatest business impact? And I should emphasize here that this is about getting real insight to decision-makers in a form they can use when they’re in the middle of making that decision rather than just having a wonderful report-writer or business intelligence solution with which they can figure out the questions and search for the answers. Please note that I haven’t treated so-called “big data” as a separate topic (although everyone’s calling anything big data at the moment) because the real goal is actionable, ideally predictive, analytics, for which the management of big data is a necessary but not sufficient capabilities.

- Embedded intelligence of all kinds — what is the vendor really doing to deliver, “out of the box,” the type of content, guidance, exogenous data, “best” practice processes and business rules, without which self service really is distributed data entry? If Amazon can tell me what I’ve been reading, what others who read what I read are also reading, and the status of every open order almost before I pose these questions, why can’t my TM software tell me which people to hire?

- Integrated HCM — this is the issue of core ERP/HRMS vendors building out TM like crazy while some TM vendors venture into core HRMS territory (absent payroll and benefits) and it’s on this list because I don’t believe that customers can afford to invest enough in talent management (and not just the technology) if their budgets/expertise/management attention/capacity for risk-taking/etc. is consumed with maintaining legacy core HRMS’ and trying to extend them with myriad add-ons nor can they easily replace those systems of record (SORs) unless there are excellent, lower cost, easily implemented and more comprehensive alternatives which integrate fully core HRMS with talent management.

- Talent management integration — where this is about having deep process-based and event-triggered integration (so not just UI or reporting integration) across all of talent management with a clear story on what the vendor includes in TM, what they don’t include in TM, what they really have of what they include, and what their plans are via product development, partnering, agnostic integration, for what they don’t have.

- Integration tools — what capabilities are provided for the inevitable integration needed across disparate HRM enterprise software components, non-HRM but interconnected enterprise software components, various HRM outsourcing providers,etc., to include integration “in the cloud?”

- Workforce management — this is about including within the (highly desired) integrated HRMS/TM foundation every type of worker and work relationship from traditional full-time “regular” employees and roles and every type of part-time employee and roles to the full range of contingent or contracted workers and roles with fixed or varying durations. The goal here is not only to understand how much work and how many workers it really takes to deliver the organization’s business results but also to create the most cost-effective delivery of those results by making the right choices of how to structure the organizations work roles and what types of workers to deploy for each.

What topics are on your list of general HRM software vendor product direction questions? I’d sure like to improve mine, so please share your thoughts.

Happy Pesach! And for those of you with a few minutes to spare, this video from http://www.maccabeats.com will get you into the right mood. For those of you who celebrate Pesach, and for those of you who don’t, my personal prayer is that every form of slavery, from physical to economic to psychological, will be wiped out in my lifetime. Happy Pesach! And for those of you with a few minutes to spare, this video from http://www.maccabeats.com will get you into the right mood. For those of you who celebrate Pesach, and for those of you who don’t, my personal prayer is that every form of slavery, from physical to economic to psychological, will be wiped out in my lifetime.

[After many vendor briefings in Q1 2011, I published a series of blog posts summarizing my reactions to those briefings which really captured, as of then, how I evaluated vendors and their products/services. Rereading those posts after a two year hiatus, I was struck not only by their relevance to my current thinking about this topic but also by how much they needed and deserved an update. If you’d like to read the originals, they can be found here, here, here, here and here. But I hope you’ll be more interested in my current thinking because two years is a lifetime in our neighborhood at the intersection of HRM and IT. The first reprise of this series, “Ambition Matters” can be found here; stay tuned for the others.]

In my first reprise of this series, I wrote about one aspect of the way in which I look at, learn about and evaluate HRM software vendors, as well as outsourcing providers, and their products and services which I follow as a consultant and so-called influencer, namely their ambition as businesses. In this post I want to take up another important aspect of that same topic, namely how I consider the competitive context in which these vendors/providers operate.

Since 1967, I’ve done due diligence on, kibbitzed, designed, programmed, done “killer” scenario demos on and contributed to more generations of HRM software than almost anyone reading this post. However, the generational change now underway — quite far along actually, in case you and/or your vendors aren’t with the program — is far more complex than those that have preceded it. We’ve had many changes in underlying technologies (e.g. mainframe to client server to native Web to cloud), we did a very big move in business models when we went from custom development to the use of packaged software, and we’ve certainly had several generations of how we build software, from “arts and crafts” to software engineering to agile and more, but there’s a lot more going on now and over the past five to ten years than just these types of changes.

What has made these last few years so challenging for all HRM software vendors and service providers is that their business strategies, in order to remain relevant and be successful, had to address many fundamental areas of change in the enterprise software business that were happening all at once. That doesn’t mean that every vendor/provider had to address every single change described below within their business strategy. But it does mean that, at a minimum, they had to make clear business decisions about each category of change, weave those decisions into a coherent business strategy, and then execute that strategy quickly and successfully. And it’s no mean feat to rethink, all at once, everything about the nature of your products/services, target markets, distribution methods, etc. etc. — and to do that very quickly. From the perspective of market influencers and buyers, understanding how each vendor/provider addressed (or didn’t) these changes in the enterprise software business provides enormous insight into their viability, and a great deal of context for understanding the rapid consolidation of many previously leading independent vendors/providers as well as the challenges faced by even the largest legacy vendors.

So what were these changes, and why did they matter? Here’s my take:

- Business models — from licensed to subscribed — and while this change and the pace of this change differ by geography/specific industries, subscribed is strongly preferred now in many to most new deals by buyers of HRM software/services buyers and by industry investors because it removes a very large and up-front capital expenditure in favor of a usage-based, ongoing expense. And while there may still be quite long contract lengths and up-front prepayment in order to secure advantageous pricing, great HRM SaaS vendors are able to create enough stickiness in the desire for their products and enough elegance in their sales through implementation processes to enable rapid and not unreasonable costs in the run-up to full production to move themselves and their customers into that productive, recurring revenue phase of the relationship and then keep them there with very low cost-to-achieve renewals — or so goes the expectation by buyers and investors and market influencers. My own view is that effective interrogatory configuration is central to the long-term financial success of this business model and that wise vendors are moving as quickly as possible to introduce these capabilities.

- Deployment models — from on-premise or 3rd party hosted to vendor hosted (ideally, in the cloud) — this change and the pace of this change also differ by geography/specific industries, but vendor hosted, ideally with the industrial strength and improved costs of the cloud, is preferred strongly in many to most new HRM software/services deals by buyers and absolutely by industry investors. From a buyer’s perspective, while there remains a key role for IT to play in the evaluation/selection/implementation (especially as regards putting any new applications into the larger and interconnected landscape of systems supporting that buyer’s organization), there’s no need to impose unduly on the always challenged infrastructure resources of their own organization. Need a sand box to evaluate and then implement a true SaaS solution? It’s provided by the vendor. Need two production tenants, one that’s physically in Europe to head off privacy concerns until such time as the underlying policies can be revised? It’s provided by the vendor (assuming you’ve selected one with global capabilities). Need to ramp up production capacity quickly to handle the launch of a new business or an acquisition? It’s provided by the vendor. Pretty sweet when you consider how low on the list the HR function can be when requesting rapid IT attention, let along demands for additional production capacity.

- Architectural models — from customized single tenant, designed for on-premise use to configured multi-tenant — not only is this essential to cost-effective, rapid time-to-market and time-to-revenue, and scalable operations for subscription/hosting by vendors, but it also opens up a whole range of new revenue sources, from selling aggregated analytics to 1-to-1 marketing. This is a particularly contentious area, and there may be situations and buyers that don’t lend themselves to multi-tenant configuration only true SaaS. More visible and noisy are those legacy vendors with a gazillion licensed/on-premise customers who are moving heaven and earth to keep those maintenance fees flowing even as they proclaim their commitment to “the cloud,” and purchase, repackage and/or rebuild add-ons which are true or faux SaaS to sell into those huge installed bases and persuade them that their path to “the cloud” will be smoothest with their incumbent vendor. All that said, this train has left the station, and the momentum is clearly on the side of InFullBloom architectural models because they offer the ultimate range of productive options for both buyers and vendors. Vendors can host and subscribe whatever they’ve got, often doing so and calling it SaaS. But doing so beggars their future in an industry where the many benefits of true SaaS will only accrue to those vendors who have it and to their customers.

- Software development models — from procedural to models-driven, metadata-rich and increasingly definitional — Workday is a good example within our industry of the improved time, quality and cost-to-market this approach delivers once the foundation tools are built/tuned (and these aren’t growing on the commercially available bush yet) and assuming the foundation object models are right and stable. More importantly, those advantages are cumulative, providing considerable leverage as each new release is built on the last one. Workday is by no means the only example of this and there’s a lot more coming. This is one area where I have to keep my mouth SHUT as to who’s doing what, but any vendor who’s not looking deeply into these capabilities is going to wish they had done so long before now. One reason why this has been the holy grail of computing for as long as I can remember is that it eliminates one of the most confusing, error-prone, costly and time-consuming steps in bringing new functionality to market, which is translating the always imperfect verbal and text requirements for product into the procedural logic of program code. By capturing those requirements within the models themselves and then letting those models be the application, much less is lost in the translation. As I’m writing this, we’re preparing to ship the very last delivery of my HRM Object Model/Architectural “Starter Kit,” and my best wishes for more next gen success stories go with it.

- User experience — from self service as an add-on, transactional/data entry-style and PC-based to mobile consumer-like self service as the only/primary service, with considerable embedded intelligence and increasingly mobile, social, multi-media, we’ve seen the consumerization of HRM software and services. And while I’m hot damn on a QWERTY keyboard and always will be, many to most of my younger colleagues, not to mention those workers who are always on the fly, are finally getting HRM delivered to them when, where and how where they need it. Even more important is that, with sufficient embedded intelligence within the HRM user experience, we really can unleash more complex and strategic HRM interactions without everything having to pass through the hands of the HR department (or even its call center surrogates) without sacrificing the quality, timeliness, completeness and risk-mitigation of those interactions. With gamification now underway (to be used where appropriate) to further engage the workforce in a wide range of learning, performance, scheduling, wellness, and many more HRM processes, we’ve come a very long way (but with much more to go) toward making HR technology as appealing, useful and easy to use as Amazon.com.

- Buyer responsibilities/behaviors — IT and business leaders play very different roles in true SaaS selection/use, with senior line business leaders taking even more control of strategic HRM software decisions, and there’s far more SaaS available on a try before you buy basis, but I believe that the interrogatory configurator approach will be the turning point for a total rethink of the whole buying cycle and process. While it’s entirely possible to get into production more quickly and less expensively with true SaaS, there’s still a lot of heavy lifting — or their should be — to be done by HR leaders to clean up years of crummy data structures, refactor codes for a more modeled environment, redesign HRM processes to be outcomes-focused rather than driven solely by administrative and compliance objectives, get serious about competency-models however socially developed, and much more in order to get full value from at least the more strategic HRM software now available as true SaaS. And inserting new software, SaaS or otherwise, into the existing systems landscape takes some serious rethinking of all those interfaces and integrations, with smart buyer/IT partners working hard to reduce the number and complexity of such interconnections. So even as true SaaS reduces greatly the demand for traditional in-house IT resources, to include all that computing infrastructure, real business analysts are in greater demand than ever to lead the HRM transformation for which great SaaS implementations may be our last best hope.

- Buyer influencers/influences — from a few major (which vary by market and HRM process) professional organizations, print journals, vendor conferences, traditional analyst firms and HR tech conferences to a host (glut?) of bloggers, Webinars, in-person and physical HR tech conferences, Twitter streams, new-age analyst firms/centers of influence, and vendor conferences, etc. — making your voice heard through the general din is much more challenging and has reshaped/is reshaping vendor marketing to be more social, relationship-based, multi-media, integrated, guerilla, and substantive. The very fact of my having a blog on which I can write this post tells you everything you need to know about what’s happened in the marketplace of ideas surrounding HRM software and services. Vendor marketing teams not only have to get their messages across to the “official” analysts and influencers, but they have to monitor and participate in a huge array of forums in which their products and companies are discussed. If you’ve been following one of the best of these, the HR Technology Conference discussion group on LinkedIn, you know how pointed can be those discussions and how much influence they generate.

- Green field versus replacement deals — almost all US companies of any size as well as many to most around the world have some level of automated HRM support. Those with more than 500 workers usually have some form of HRMS, but often with outsourced payroll processes, and at least some strategic HRM functionality, either via their HRMS or via talent management software add-ons. For most companies of any size, it’s no longer just about getting the payroll done and avoiding compliance woes but rather about the need to deploy a productive and engaged workforce. As a result of 40+ years of automating at least payroll, many to most of today’s and tomorrow’s HRM software/services deals are replacing some earlier form of automation, if only spreadsheets and user-developed databases. And buried in all that prior automation are the crummy data structures (anyone remember when we were limited to 80 character records?), worse coding structures (the ubiquitous employee status code into which we threw everything but the kitchen sink — but surely that was killed off a couple of generations ago?), important historical data that must be brought forward or which will require us to wrap and maintain at least reporting capability so we can access old data, and myriad other implementation issues that must be addressed as we move forward in a way that doesn’t drag the past along to hobble our future. Frankly, if I hear one more influencer/consultant/vendor/anyone say you can migrate from your legacy pile of interfaced/faux-integrated/so tightly integrated that all business change is prohibitive to that shiny new fully integrated HRMS/TM platform or keep yourself afloat with some convoluted combination of all of the above, I’m going to scream! It’s truly time to rethink, redesign, rip and replace those older systems that are constraining our ability to deliver agile, modern HRM processes that drive business results. No pain, no gain!

- Sales/implementation models and timelines — more than in any time I can remember, and its axiomatic in the case of true SaaS because of the very different business model, there is tremendous pressure on vendors to: (1) shorten initial elapsed time/cost to customer and vendor value — consider impact of channel partners and interrogatory configuration, (2) absorb most of the cost, and not get subscription revenues until customer is in production — significant accounting issues here for revenue recognition, etc., and (3) shorten continuously the elapsed time/cost to value as vendor rolls out new releases and/or customer needs change. I’ve noted above the architectural foundations, interrogatory configuration and models-driven development being two of them, for addressing this particular strategic challenge, but there are many more dimensions to this particular challenge that can’t be addressed solely by software design. The competency profile of our best salespeople for licenses/on-premise enterprise software, and the incentive compensation plans and other HRM policies that drove them to achieve the needed business results, must all change for true SaaS. On some level, there’s the opportunity to eliminate much of what traditional enterprise software sales people, and pre-sale consultants, do, replacing it with marketing that reaches beyond HR, freemium software trials, and interrogatory configuration to move prospects to be come customers and then through continuous adoption.

- Growing ownership by private equity firms — and, in some cases, for longer periods of time — but with wildly different investment philosophies: (1) invest, turnaround, grow, operate, return profits, but this is rare, (2) dress up and flip in a few years, (3) milk a maintenance/subscription revenue stream, doing just enough to prevent customers from absorbing the pain of moving, and (4) longer horizon but not operators. Where once a floundering HRM software vendor either went out of business or was bought for its installed base and/or maintenance stream by one of the software graveyards/aggregators, the presence of private equity firms allows for some very different scenarios in terms of both maintenance stream milking or investing for growth/renewal. Many very capable and growing HRM software and services firms are owned entirely by private equity firms, using new capital provided by these firms to seize opportunities that they just couldn’t do on their own. On the other hand, there are also firms in our industry whose private equity owners are doing quite the opposite, squeezing all investments to reap maximum short-term profits. With no time just now to do a complete update, this post still makes a useful contribution to this part of the strategy discussion.

- Growing consolidation — many factors at work here, not least of which is the emergence of true SaaS puting pressure on vendors: (1) to achieve the scale/new markets needed to support fixed cost aspects of the business and deliver the growth/margins needed to support IPOs and/or (for already public companies) desired stock prices/multiples, (2) to buy growth as a cover for their inability to achieve sufficient organic growth and/or to support the increased investments needed to re-architect for true SaaS, and (3) to re-architect, not just for multi-tenancy but also to address newer/less costly development approaches, rising customer expectations re: mobile/social/richness, increasingly global (or at least multi-national) customers, new and/or evolved competitors, etc. Many of us have questioned the high G&A spends of some of the most visible and rapidly growing HRM software vendors, but if you believe that true HRM SaaS is a consolidating landscape wherein there will only be a very small number of vendors left standing in each important segment, then a “land grab” and huge R&D investments may make more sense than trying to increase profits substantially in the short-term.

I believe that we’ve reach (perhaps passed?) a major industry inflection point, not only about taking advantage of new technologies but also about changing business models and deployment options. In my view, those smaller HRM software vendors which haven’t made huge progress toward adjusting to these changes will not be viable/independent much longer, but I’m sure the software graveyards will make room for the best of them. Even the biggest ERP/HRMS vendors, the titans of old, will struggle to continue their domination unless they succeed in turning themselves into great true SaaS players — and quickly.

If you’re a vendor, you may want to consider how well your stated (real?) strategy addresses the contextual changes I’ve noted above — and there are myriad variations on all of these changes as well as myriad effective means of addressing them — and be sure that you can explain during briefings how your strategy approaches each of these areas. If you’re a buyer/end-user, be sure that your vendors are truly on top of these changes and that your firm’s needs are a good fit for the direction your vendors are taking on each of them. As you look at vendors and their products, the items above constitute a pretty good checklist for assessing their viability from a business strategy perspective. For unless they are on the right track with real momentum across the applicable items from this list, I just don’t see them being great partners for this decade.

Boy, what started out as a modest update of my earlier post on this got right out of hand, but that seems to happen to me with some regularity. Guess I’m just not a sound bite kind of blogger.

Show Me The Money! [After many vendor briefings in Q1 2011, I published a series of blog posts summarizing my reactions to those briefings which really captured, as of then, how I evaluated vendors and their products/services. Rereading those posts after a two year hiatus, I was struck not only by their relevance to my current thinking about this topic but also by how much they needed and deserved an update. If you’d like to read the originals, they can be found here, here, here, here and here. But I hope you’ll be more interested in my current thinking because two years is a lifetime in our neighborhood at the intersection of HRM and IT. This is a reprise of the first of that series; please stay tuned for the others.]

I take a ton of briefings/demos with HRM software and services vendors, really as many as possible for this solo whose day job as a working consulting keeps her quite busy. And since I’m absolutely not an analyst of the Gartner/Forrester/IDC or smaller firm persuasion, for whom taking vendor briefings is a key part of their day job, let me start this post with a major shout-out to all the vendors with whom I’ve met and will be meeting for their time, their preparation, and their courtesy. I know that it’s a major draw upon vendor leadership time to keep all we so-called influencers informed about their business, their products/services, and their industry perspectives, and I for one am very grateful to everyone involved in these briefings. Hopefully I’m giving as good as I’m getting so that their time is as well-spent on these calls as is mine.

One of the questions I always ask vendors, as context for learning about their business and products/services, is “what is your ambition?” Ambitions for organizations change over time, and they should do so as competitive, industry and organizational changes argue persuasively for such changes. And it’s a wise leader who is realistic about what it will take to realize their ambitions and the extent to which their assets are sufficient and a good fit for doing so. But understanding a vendor’s ambitions, what they hope to accomplish and are working toward, tells you a lot about what types of buyers and business needs might be a good fit for them — always assuming they’re half-way competent and able to deliver decent products/services as promised.Within the HRM software/services industry, we’ve got leaders with enormous ambitions in whom we have confidence of their achieving them because they bring so much to doing so in terms of experience/track record, financial resources in hand or easily obtained, and tons of talented people ready to follow them wherever they lead. And then there are those leaders in our industry who have squandered their assets, damaged the talented people who found themselves working for them, and never came close to realizing their ambitions (or snatched defeat from the jaws of victory) because of their own fatally flawed KSAOCs and decisions — and their inability to adjust their ambitions to fit their capabilities.

And then there’s Naomi. One ambition I had personally and did achieve before my legs stopped working well enough to do it (which adds the dimension of timing, because ambitions must evolve to meet the current reality, or at least they should) was to climb a number of the more remote Mayan pyramids. Professionally, one ambition I set for myself in 1987 when I started my solo practice was to help change the practice of HRM from a focus on administration with an emphasis on labor cost control and systems which were basically file cabinets and payroll calculators to a focus on achieving business outcomes via integrated strategic HRM processes enabled by systems that managed KSAOCs at their core, with all that implies.

I know that I wasn’t the only voice pushing for these changes in the practice of HRM and the software available to deliver it, but I will take a tiny bit of credit for the fact that most of today’s HRM systems are KSAOC-centric, focused heavily on enabling strategic HRM processes, and very much attempting to drive business outcomes via improving workforce decisions. Climbing those pyramids and seeing my fingerprints on a good bit of today’s HRM software are two ambitions realized, each in their own time and each requiring me to make fundamental choices about what I would do and, VERY importantly, what I would not do in using my own limited resources and KSAOCs to achieve my ambitions.

This is why I’m so interested in each vendor’s ambitions as a backdrop to learning about their strategies, products/services, target markets, etc. etc. Those ambitions really matter when you evaluate a vendor’s viability, their likelihood of acheving those ambitions, as you look at their organizational assets, their bench strength, their software assets and services infrastructure along with their intellectual property. Successful organizations are those whose assets are sufficient to realize their ambitions — how obvious is that! — but it’s always amazing to me how many organizations (and people!) are out of sync on this point. And if you’re a buyer of HRM software/services, you’d better keep a very careful eye on this point to ensure that, as they pursue their ambitions, your vendors are serving yours.

What may be less obvious is that, within our industry, there are generally three very different patterns of organizational ambitions. These patterns do vary for a given organization over time – and they should — because smart leaders, as noted above, evolve their ambitions along with reality. However, these organizational ambitions also evolve because businesses that are failing to achieve one set of ambitions may well set their sights differently when faced with that reality. Although there are many variations, and individual organizations do evolve in terms of their ambitions, I’ve observed three major patterns of organizational ambitions within our industry.

Lifestyle Businesses

These are businesses which are founded or run to support the modest to affluent financial needs while fulfilling the professional passion of their founders or leaders. Bloom & Wallace is a good example of this where my professional passions are well-known. What’s less well-known is that I’ve stayed a solo, in spite of opportunities for much greater wealth, so that I could:

- Work with many more industry players in an impactful way than I could have done by working with just one industry player,

- Focus exclusively on my clients without the obvious creative tensions of supporting a whole consulting enterprise,

- Accommodate my husband’s career, which was in the Washington, DC area for 22+ years, which isn’t exactly a hotbed of HRM software/services HQs,

- Build/license/support a body of intellectual property that is vendor neutral but which has influenced the current and next generation of HRM software,

- Travel widely when and where we choose with only the need to plan far enough in advance so as not to disrupt client projects, and

- Adapt to the needs of my aging body.

There are many such HRM software and services firms, making money for themselves and their investors (where they have investors), providing often quite wonderful work environments for their staff, and contributing mightily to our industry — and they aren’t all small. For the customers/clients of these firms, they’re often a great pleasure with which to do business, can be quite innovative and agile, and rarely have unhappy customers because they couldn’t survive if that were the case.

But it’s also rarely the case that, at least among HRM software/services companies, larger and more global end-user organizations are well-served by having a lifestyle vendor at the center of their HRM delivery system except where these founder-led vendors are morphing into a form which will survive and prosper beyond the founder’s tenure. When Bloom & Wallace finishes a client engagement, we’re off that client’s critical path and aren’t responsible in an ongoing manner for their HRM service delivery foundation. From the perspective of product/service buyers, you may not want to be unduly dependent on a lifestyle vendor unless they and you are prepared to accept the risks of their inevitable adoption of one of the other two ambition patterns or the ending of their business.

Built To Be Bought Businesses

These are businesses, often founded by serial entrepreneurs with their own or investor money, which fill an opportunistic niche in our market, innovate in an underserved area, find a need and fill it. But, unlike the run/grow/dominate businesses, the built to be bought businesses usually don’t take on a scope of product or services which is large enough, by itself, to generate the type of return that the investors may require or to which the founder aspires via an IPO nor with a large enough and sustainable enough niche to simply grow and profit their way to those wanted/needed returns.

Successful businesses of this type — and they are legion in the IT world and within our own HRM software/services industry — know (or should know) from their earliest days who their likely buyers are, what those buyers value, and how they can develop enough interest from enough buyers to achieve the desired multiple when they do sell. And while some such businesses are started with this ambition from day one, many more start out as lifestyle businesses which turn to buyouts as their founders/owners want liquidity, retirement, or just out.

From the perspective of their customers, knowing that your vendor is going to be bought is VERY important for your own planning. Are you okay with having your contract now serviced by a much larger vendor, perhaps one which you didn’t select in the first place? One which may force you off of the software/services that you chose and onto something else? Or perhaps one that will save you from a dying product, replacing it with their much more survivable one? Whatever the case, there’s disruption ahead, even if the outcome is a very good one. And knowing that your vendor/provider is likely to be bought helps you decide where you’re willing to use such vendors within your HRM service delivery.

Built To Run/Grow/Dominate Businesses

And then there are the businesses that are started with the clear and stated intention of being grown and run to dominate an important industry segment, and one that’s big enough to offer them almost limitless possibilities in terms of revenue and profitability. These are the businesses whose founders, at least in our industry, are redefining how we think about a major market segment, how products/services are built/sold/delivered/priced/etc., and how we think about HRM and the HRM delivery system.

Now that doesn’t mean that these ambitions are always realized — they most often aren’t — but when combined with the right assets, these are the ones to watch over the long run. And these are the ones on whom we want to bet for our core HRM delivery system platform. Some to many of these firms go public (hopefully when they’re big enough and with sufficiently industrial strength internal processes not to be overwhelmed by the demands of being public), and some remain incredibly successful but privately owned, but businesses with this ambition become the very backbones of our HRM delivery systems.

From a buyer’s perspective, you rarely get leading edge capabilities for the core components of your HRM delivery system unless you jump on board with one of these vendors when they are themselves early days, and that means being an early adopter. Once these companies have achieved their ambition, it’s very hard for them to remain as innovative, as agile, as aggressively focused on their customers’ success as they did when they were hungrier, but by then they become the “safe” choices for buyers who aren’t early adopters. And sometimes these very same vendors, or at least their leadership teams in a new endeavor, having grown large and successful, surprise us by delivering their own next generation of products/services.

The Bottom Line

There’s no such thing as a correct ambition, but there are viable combinations of ambition and assets. Do you know the ambitions of all of your HRM software /services vendors? Do you know how well they are doing against those ambitions? How good a fit are their assets for achieving those ambitions? Have you matched the ambitions of your vendors, presuming that they are moving toward achieving them successfully (because you certainly don’t want to rely on vendors who are failing to do so), to the role that their products/services play in your HRM delivery system? Have you bet the farm on a vendor’s failed (or likely to fail) ambition to run/grow/dominate the HRM delivery system platform? Does one or more of your talent management “best of breed” vendors fit the profile of built to be bought, whether deliberately so or because they’ve failed as a run/grow/dominate business? Just as I want to understand the ambitions of the vendors/providers with whom I’m taking briefings so that I can look at their products/services etc. against that backdrop, so too should buyers of these products/services take a hard look at the fit between what they need and what they vendor/provider’s ambition will lead them to deliver. Ambition matters!

Those who know me well know that one of my greatest pleasures is opening, literally, a new mystery book of the British cozies flavor. These are the types of mysteries written during the Golden Age of British mysteries by the Queens of this genre: Agatha Christie, Ngaio Marsh, Dorothy Sayers and Margery Allingham. I so wish these amazing authors were still writing, but fortunately they all left very large collections that I’ve enjoyed reading and rereading over the last 60+ years. And of course there are many, many other authors of this genre, some of whom are very much alive and well and writing. Those who know me well know that one of my greatest pleasures is opening, literally, a new mystery book of the British cozies flavor. These are the types of mysteries written during the Golden Age of British mysteries by the Queens of this genre: Agatha Christie, Ngaio Marsh, Dorothy Sayers and Margery Allingham. I so wish these amazing authors were still writing, but fortunately they all left very large collections that I’ve enjoyed reading and rereading over the last 60+ years. And of course there are many, many other authors of this genre, some of whom are very much alive and well and writing.

I’ve been inspired by these authors and their work, and I’ve often thought that there’s a mystery series in the characters and settings of our little neighborhood at the intersection of HRM and IT. Nothing ugly or violent or with too much sex, just little cozies that take place among a tightly-knit community with suspects galore, the occasional closed room murder, and a clue under every iPad.

And today’s Twitter exchange about how slowly self service is rolling out (when it should be ubiquitous by now) got me thinking about where to start my series. First up, “Death by Lousy HRM.” Then, “Mystery of the Missing High Performers.” Followed quickly by “Career Death at Late Adopter Inc.” Lots to think about here, and I’ll need some continuing characters. But I think I’m seeing a little something to do with my “idle” moments, should I ever have one, that would allow me to tell tales of technical debt, reveal the murderers of best practices, and put the suspects through the ringer. Now who should be my first victim?

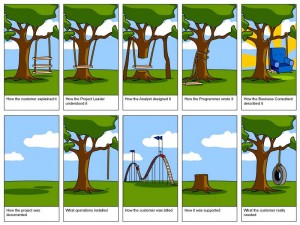

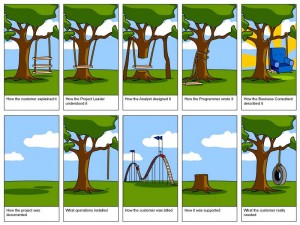

There Are So Many Causes Of Project Failure There was quite a lot of discussion on Twitter and in the blogosphere earlier this week about a major payroll project disaster plaguing the State of California government. That discussion broadened to include tales of more failed payroll as well as ERP and various other large-scale systems projects. If you want to immerse yourself in tales of such disasters, fellow Enterprise Irregular Michael Krigsman has written a ton about such projects as have many others.

Following the back and forth for a while, one thought kept running through my head. It was one expression I heard often at my last real job, the last time I had an actual employer. At AMS, it was understood that there were no stars on a failed project. Regardless of whether the client or we were at fault, or perhaps it was the fault of the occasional packaged software vendor with whom we worked or their products, there was usually egg on everyone’s face by the time the dust settled on such a project.

Did we collectively head off the ingredients for failure by walking away from every project that didn’t have all the ingredients for success? Were client expectations ever realistic? Was the software we built or the vendor product we used ever as good as it needed to be, as fit for purpose as one could have wished? Did we put together the A-team in every respect on every project? Did the client? Did the package vendor? Did we avoid betting on technology that didn’t mature quickly enough, or on the staying power of client leadership, or on the other million possible sources of failure? Nope, well at least not on my watch. For all the many successful projects, some inevitably weren’t. And I for one felt the heat of those failures — and hopefully learned from them.

One of the reasons I’m very suspicious of high flyers who never land long enough to feel the heat of their project failures, of their flawed decisions or flawed hires or flawed strategies, is that they don’t stay around long enough to learn from those failures, let alone to own up to their own responsibilities in them. The reality is that we all screw up unless we’re hiding under our beds contemplating our navels. But the folks I value highly are those who learn from their mistakes and from the mistakes of others. They practice their craft, build upon those lessons, and become much better craftsmen

Motivated by all this discussion, I created another one of my little video cartoons. I hope you enjoy it.

http://goanimate.com/videos/0UfMf3K5G2HQ?utm_source=linkshare&uid=0vE03Q6tXIEU

There But For The Grace Of G-d Go Us! [The original version of this post was published here in January, 2012, but a call I did last night with a magazine editor reminded me that we must emphasize just how important it is to start any HR technology project with a well-grounded strategy. Far too many HR leaders (and CFOs, line of business leaders, and more) are still playing whack-a-mole with a laundry list of automation, process, business rule and/or business outcome pain points. They tackled those pain points as they arose rather than settling down to do the strategic planning that would have put them in front of those damn moles and equipped them to win the battle, once and for all. In case you forgot what those damned moles look like, here’s a good list with which to get started mole hunting. And please note that when I do a reprise, it’s not a reposting as is but a fresh review of an old friend, editting/updating as I go.]

Dear Sir/Madam,

We may not have met, but I’ve got your back. I’m on your side when it comes to using effective HRM practices and business rules to drive improved business outcomes in your organization. I know how hard it is to draw those lines of sight from needed business outcomes, like faster time to market, lower costs of higher quality customer service, greater insight into customer profitability by market segments, and greater organizational capability to support global growth, to the specifics of what HR does to improve HRM. And I know absolutely that information technology is not the answer but rather just one of the critical tools in your arsenal when it comes to attacking your toughest challenges.

Information technology can be a real power tool, providing enormous leverage when used well. Or it can cut you and your career off at the knees when mishandled. And all too often, through ignorance, benign neglect, delegation to whoever leads comp and benefits, or knee-jerk subservience to the IT powers that be, you’ve been cut off at the knees. One only has to read the latest headlines about failed HR technology projects to confirm your worst fears about undertaking one.

Help (which is just one letter off from hell, so we can’t afford to wander) is on the way. But there’s a fair amount of work ahead if you’re going to take charge of how, when, at what cost, against what objectives, with what redesigned processes and business rules, using what types of high quality data, with what governance, etc. you deploy the power tools of IT to the benefit of your firm’s effectiveness in HRM and, more importantly, to the achievement of needed business results.

First up, you need to get comfortable with the idea that technology per se is not the answer to any important business question any more than 42 is the answer to “what is the meaning of life, the universe and everything?” There just aren’t simple answers to important business questions, but that doesn’t mean there aren’t answers. And where technology is concerned, driving business outcomes via effective HRM is much more about knowing what effective HRM would look like, knowing what practices applied to what parts of the organization would generate the most overall benefit. Once we understand what’s needed in HRM to drive those business outcomes, we can figure out what combination of technical tools, deployed how, with what functionality and so forth are needed to support those practices.

For many years I’ve used the metaphor of “Follow the Yellow Brick Road” to describe the thought process that takes us from well-defined business outcomes to well-defined HRM practices/organizational designs/business rules/analytics/etc. and right on to the design and delivery of the needed operational capabilities, the HRM delivery system, needed to conjure up your own Emerald City. You can read about that approach at your leisure using the links at the end of this letter.

After you’ve slogged your way through all of that, and having cured any insomnia from which you may have been suffering, I’d like to suggest that, with the help of a select team of business, HR and HR technology/delivery system leaders, you begin work ASAP to refine your HRM and HRM delivery systems strategy. But how and where do you begin this journey?

- Gather all of the organizational strategy, current state HRM and HRMDS information you can find. Read it all through the lens of strategic HRM, looking for the specific impacts on business strategies and outcomes that must come from well-executed strategic HRM. See the patterns in those strategic HRM requirements and design HRM policies etc. to deliver them. Then prepare to update your HRM policies, practices, and operations to support converged HRM and HR technology.

- Assign someone to inventory your current HRMDS, including all the “informal” components. What software are you using — brand/module/release — and what is it costing, including both direct and indirect out-of-pocket costs as well as the associated (and often much more important) opportunity costs? What outsourcing are you doing — provider/scope of service — and what is it costing, including both direct and indirect out-of-pocket as well as those pesky opportunity costs? What spreadsheets, Word documents, private databases, and even paper files (gulp!) are you depending on for some of your HRM processes?

- Learn all you can about the differences between poor, good and great HR technology, and about what the market offers — continuous learning needed here because the goal line keeps moving. There’s a ton of material on my blog (here, here and here are some good starting points), and an absolute must is attendance at a major HR technology conference. I’ll be speaking again this year at the big Kahuna of such conferences, LRP’s HR Technology Conference (and honored to have been a speaker at every one of these amazing conferences since their inception except when a hurricane threatened our home and a sister by choice lost her son). I will also be speaking at the newer but rapidly growing European HR Technology Conference.

- Clean up your HRM data — including organization data, people data, competency models, business rules, and data granularity — to support converged HRM and converged HR technology. Start with the most important roles, organizations, KSAOCs, whatever, but you really can’t do anything decent with analytics unless your data is sufficiently reliable, granular and properly structured.

- Insist upon detailed product roadmaps, with dates, against which to evaluate vendors and providers for evidence that they’re on top of converged HRM and converged HR technology — and do probe for their strategies around all eight convergence themes mentioned in the blog post on this you will have read in step #3 above.

- Determine what components of your current HRMDS platform are serving you well, which are not, what needs to be upgraded/enhanced/replaced, what can remain as it is (but keep an eye on this as all components “age”). Design your future HRMDS to deliver those strategic HRM requirements and then make your HR technology decisions. Be disciplined and methodical in evaluating potential HRMDS platform component changes, or changes in people and process, and don’t be a victim of vendor “promises.” Weed out/de-emphasize vendors and providers who can’t take you to a converged future — and run away from those that don’t even know that the converged future is coming.

- Do not judge the needs of tomorrow’s workforce or HRM by yesterday’s standards, but do judge your own responsibilities and their results in terms of driving business outcomes.

You obviously don’t have to do all the heavy lifting yourself; there’s a ton of staff work discussed above that’s properly delegated. But it’s important that you get just as comfortable discussing — and then making “bet the farm” decisions about the technology-enabled aspects of HRM as you’ve become (or been expected to become) discussing and making decisions about the financial aspects of HRM. And there’s not a reputable MBA program of any substance that leaves out any of this — IT, finance, HRM, and operations management — which is why I’m so grateful for mine earned in the distant mists of HR technology history.

We may not have met, but I’ve got your back. Sincerely yours, Naomi Bloom

Follow The Yellow Brick Road Part IV/Finale: The HRM Delivery System!

If you feel like you’ve been stranded along the way or that we’ve (or you’ve) been off on various scenic detours, my apologies for not providing the final installment of our Yellow Brick Road travelogue as quickly as I had hoped. Life just keeps happening; we keep up as best we can. And if you’re just […]

Follow The Yellow Brick Road Part III: HRM Strategies, Outcomes And Design

My apologies for the long detour from the Yellow Brick Road while I attended to heavy business travel, client deliverables, more shoulder rehab, and the final business details for closing on M/V SmartyPants. More on SmartyPants in a later next post, complete with pictures. For now, we’ve got a lot more work to do along […]

Follow The Yellow Brick Road Part II: Vision, Strategy And Outcomes

In Part I of our journey down the yellow brick road to great HRM and HRM delivery systems, I set the stage in terms of the environment in which our organizations must operate and what they must do to be successful. By now you should have decided for your own organization – or will do this shortly […]

Follow The Yellow Brick Road Part I: Business Environment And Challenges

In my 2/9/2010 post, I announced that I would be publishing my strategic HRM delivery systems planning methodology on this blog, so I thought I’d better get started. Although there’s a very geeky set of materials to guide me on these projects, I call the version of my methodology intended for clients, “follow the yellow […]

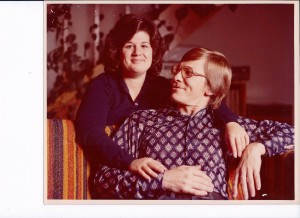

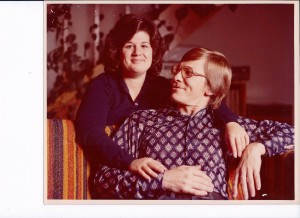

Naomi and Ron, The Way We Were [ We’ve been revising our business strategy, mix of clients, project types, and so much more on a regular basis since 1987, but this is the first time we’ve made such changes in the era of social tech. My own view is that we should be as transparent online as we are IRL, and that’s the impetus for this post about the current round of such changes.]

Context: A Stroll Down Memory Lane

One minute it’s 1972, you’re twenty-six, getting your MBA, getting married, spending your honeymoon camping cross-country, job-hunting in Silicon Valley with your new husband, and feeling physically invincible. Mainframes ruled, the possibility of packaged HRM software was finally being considered (here’s a 1976 InSci ad, EEO legislation was just being implemented, self-service referred to those New York AutoMat restaurants (which, according to my friend Bill Kutik, were called by their most prominent brand, Horn & Hardarts, by those in the know locally) to doing your own key-punching, and Ron and I were finding out what it really meant to sign up with each other for the long term.

40+ years later everything, and I do mean everything, has changed, not once but over and over again. Personally and professionally, it’s been a wild ride and a mostly terrific one. I feel tremendous satisfaction in the progress we’ve made, that our industry has made, that technology has made. But I also feel tremendous frustration that we’re not where we’d like to be. In spite of the tremendous progress in technology, and in spite of a ton of hard work all around, in far too many organizations we’re not driving business results to where they need to be and should be via technology-enabled and very effective HRM practices. Lots of important work to do before we declare victory, so we’d best get on with it.

Somewhere along the line, when I wasn’t looking, 40+ years of a road warrior’s work life, of cramming two years of living into every calendar year, of pushing hard to keep up, innovate, stay relevant and excel, all the while investing in my personal life, have taken their toll. 40+ years of working into the night before every vacation (but I’ve always treated vacations as sacred even when they were wedged into the cracks of my professional life), then flying off with Ron or my girlfriends to go sailing in the Caribbean before going right back to work without so much as a moment for re-entry, that’s a pace that isn’t sustainable much past your mid-60’s even though one’s brain and passions have aged very gracefully. There are just so many red-eyes (I lost count at 100+) that you can take before you swear off of them forever!

Now my days of climbing the Tomb of the Inscription at Palenque, pulling consecutive all-nighters during HRMS go-lives, and dancing the Llambada all night long at an IHRIM after party — yes, I too had my prime — are well behind me. But I’m damned glad I did all that and much more while my joints could handle the strain. And the lessons I’ve learned, the great people I’ve known, and the sense of accomplishment along the way have been well worth all that effort. That’s why my advice to all my younger colleagues, family and friends is to live large, push yourselves to accomplish as much as possible before life inevitably intervenes to slow you down, if only a little.

It’s a brave woman who accepts the passage of time without doing a little nip here and a little tuck there. And it’s a wise one who adjusts her goals, professional commitments and lifestyle accordingly. I’d like to think that I’m both brave and wise (I’m neither, but I’d like to think that I am), so I’ve been open about aging, I’ve moderated gradually my business travel over the last few years, and many of you have seen me riding a scooter (with Ron power walking beside me) at larger conferences. But in all those 40+ years I’ve never given myself permission to deliver client work that’s not up to my own high standards. And I’m not about to start now!

B&W Strategic Review